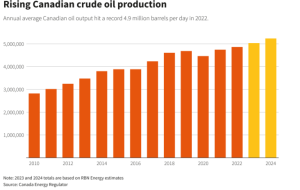

Canada’s Oil Production Expected to Grow in The Next Two Years

Despite facing a challenging second quarter marked by oil sands maintenance activities and early summer wildfires, Canada’s oil industry is gearing up for a robust resurgence in production. As published by Reuters, analysts are projecting a remarkable 8% increase in the country’s total crude output over the next two years, a surge that could potentially outpace the cumulative growth achieved over the past half-decade. That could mean lower fuel prices for consumers in Canada and the midcontinental US.

According to Canada Energy Regulator data, Canadian oil production averaged 4.86 million barrels per day (bpd) in 2022, up from 4.61 million bpd in 2018.

An important aspect of this strategy is the adoption of “step-out” or “tie-back” oil sands thermal projects. Instead of constructing entirely new facilities, companies are capitalizing on existing infrastructure by linking new extraction areas to established processing plants. This innovative approach not only accelerates development but also offers substantial cost savings. Industry experts suggest that this renewed focus on production expansion is indicative of a growing confidence in the stability of oil prices.

The new volumes will also align with the imminent launch of the Trans Mountain expansion (TMX) pipeline project, expected to add a significant 600,000 bpd to the nation’s capacity in the first quarter of 2024. However, potential delays in the TMX project could potentially result in pipeline congestion, potentially necessitating a shift to crude transportation by rail at higher costs.

As Canada endeavors to navigate the delicate balance between economic growth and environmental initiatives — the country expects to reduce by 40-45% carbon emissions by 2030 — the upcoming surge in oil production underscores the complex interplay between energy demands, sustainability goals, and industry dynamics.

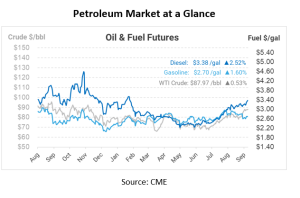

For consumers, more Canadian oil production could push down WCS crude index prices, which makes crude cheaper for Canadian refineries and Chicago-area refiners buying this type of oil. Those refineries push products throughout Canada and down into the midwestern US, including the Dakotas, Illinois, OH Valley, and even as far east as Pennsylvania.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.