Natural Gas News – September 7, 2023

Natural Gas News – September 7, 2023

Natural Gas Prices Forecast: EIA Report to Push Stocks

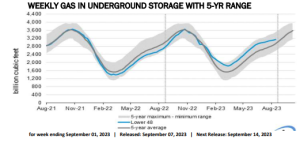

US Natural Gas futures showed a modest decline on Thursday, facing pressure just before the anticipated release of the government’s weekly storage report. This downward trajectory brought the futures market to its lowest since June 13. Factors influencing this include the expected easing of demand next week and a notable pause in a looming strike in Australia. As of 10:30 GMT, October’s natural gas stands at $2.507, witnessing a $0.003 or -0.12% dip. The U.S. Energy Information Administration (EIA) is gearing up for its weekly storage report release at 14:30 GMT. Projections hint at a build of 38 Bcf for the week ending September 1. An overview reveals that working gas in storage tallied at 3,115 Bcf by August 25, 2023. This indicates a net increase of 32 Bcf compared to the preceding week. When set against…

An Escalating Dispute at Major Gas Facilities in Australia

The looming threat of strikes at Australian natural gas facilities will keep global gas markets on tenterhooks, energy analysts told CNBC, with traders fearing that a prolonged halt to production could squeeze global supplies and send European prices higher. U.S. energy giant Chevron and unions representing workers at the Gorgon and Wheatstone projects in Western Australia are in daily talks this week to try to come to an agreement over pay and job security. The Fair Work Commission, Australia’s independent workplace relations tribunal, is mediating talks between both sides. If a deal cannot be agreed, the strikes are scheduled to begin from 6 a.m. local time Thursday. The long-running dispute escalated even further on Tuesday as a union alliance announced plans to strike for two weeks…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.