Natural Gas News – August 29, 2023

Natural Gas News – August 29, 2023

Natural Gas Prices Forecast: Gulf Weather, Australian Strikes

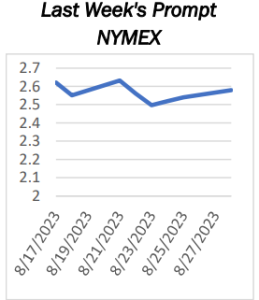

Natural gas futures spiked significantly as speculators considered the potential impacts of a hurricane in the Gulf of Mexico on key production plants. Despite the storm’s eastward trajectory, it is the western Gulf that houses these crucial facilities. While the U.S. National Hurricane Center warns of potential intensification of Tropical Storm Idalia towards Florida, power outages in the state could have bearish consequences for natural gas prices, given Florida’s reliance on gas for electricity. Further influencing global natural gas dynamics, Chevron’s workers in Australia are on the brink of authorizing unions to call strikes at major liquefied natural gas (LNG) facilities. This follows recent votes at Chevron’s Gorgon and Wheatstone facilities, which, combined with Woodside Energy Group’s projects, account for a…

Natural Gas Price Forecast – Natural Gas Markets Continue to Hang

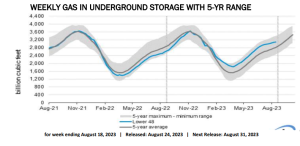

Natural gas markets have opened up on the upside during the Tuesday session, showing signs of bullish pressure yet again. That being said, the market is hanging around the 50-Day EMA, which of course is a significant technical indicator that people have on their charts. All things being equal, this is a situation where we have tried to build a larger “basing pattern”, as we are getting close to the end of summer in the northern hemisphere. Typically, this is the time a year where natural gas starts to climb, due to the fact that the demand will start to pick up. Furthermore, we also have to worry about the European Union, and whether or not they are going to have enough natural gas this winter. I suspect that we are going to see quite a few problems with supply in the European Union, as…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.