Goldman Sachs Report: Energy Industry Ramps Up Spending on Oil and Gas Projects

In a surprising turn of events, the global energy industry seems to be making a comeback in investments. Executives from major oil corporations are steering their financial commitments toward their core operations of oil and natural gas exploration and development. The report “Top Projects 2023”, by Goldman Sachs, reveals a boost in investment activity.

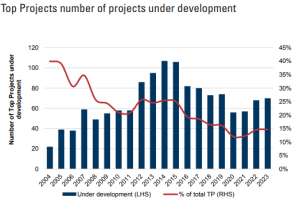

The energy industry has kicked off an impressive 70 major projects under development in 2023, which is 25% more than in 2020. This renewed interest in exploration and development comes after a period of decline from 2014 to 2020 when companies weren’t spending as much on finding new oil reserves.

Source: Top Projects 2023

There were different reasons behind this decrease, including environmental concerns, pressures from investors interested in environmental and governance issues, and the desire for higher profits after the US drilling rush from 2009 to 2015. When the COVID-19 pandemic hit, companies had to halt their projects to save money, resulting in only 56 major projects in 2020.

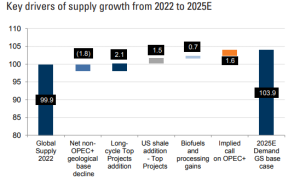

Goldman Sachs’ report underscores that this period of low investment is expected to continue impacting supply growth for years. The report points out that the repercussions of 2015-2021 make it unlikely for non-OPEC producers — which includes the USA (#1 producer), as well as Canada and China — to experience a quick rebound in output growth, even with the recent surge in capital expenditure.

Source: Top Projects 2023

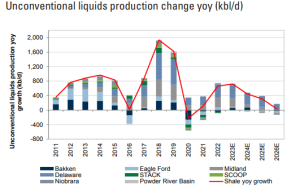

Challenges in US Shale Oil

While US shale oil projects take less time to develop, they’re still dealing with difficulties such as higher costs and limited access to funds. The number of active drilling rigs has dropped by 20% in 2023, and this trend might continue for the rest of the year. Despite these challenges, Goldman Sachs remains positive about US shale production through 2024. Even though the number of drilling rigs has decreased, US producers are expected to match the 1 million barrels per day in new production that was seen in 2022. The report projects a moderate increase of a half-million barrels per day in 2024, thanks to the industry’s demonstrated ability to adapt and grow over the last 20 years.

Source: Top Projects 2023

One prevailing issue impacting investment decisions is the notion of “stranded assets,” meaning that a lot of the oil we know is underground might not be used as the world moves to cleaner energy. According to Goldman’s study, these worries are a big reason why there’s less investment, which has led to a drop in how long we can use oil – from over 50 years in 2014 to only 23 years now.

Despite these concerns, the report highlights improved project economics since 2014, with a significant proportion of undeveloped resources projected to be profitable, even with the Brent price below $70 per barrel. This economic landscape, coupled with lower emissions plans, has increased the industry’s motivation to start new projects.

As geopolitical shifts shape the new energy landscape, the industry has embraced the urgency for more oil and gas investment. As the world transitions to cleaner energy, fossil fuels will still be needed to bridge the gap, requiring more investments to keep up with rising global energy needs.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.