Is OPEC Losing Influence?

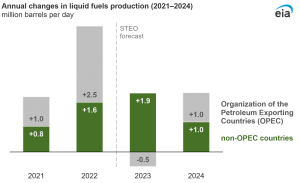

There’s a group of oil producers that have long held sway over global oil markets – the Organization of Exporting Petroleum Countries, or OPEC. Recently, however, the EIA’s energy outlook has predicted a shift of production growth from OPEC to non-OPEC countries in 2023 and 2024. This means that countries that are not part of the Organization of the Petroleum Exporting Countries (OPEC) are expected to increase their production of liquid fuels, such as crude oil and natural gas liquids. This is a significant shift from previous years, where OPEC countries were responsible for the majority of the world’s oil production.

The EIA expects non-OPEC liquid fuels production to grow by 1.9 million barrels per day (b/d) in 2023 and by 1.0 million b/d in 2024. To put this into perspective, one barrel of oil is equal to 42 gallons. So, the expected growth in production would be equivalent to about 80 million gallons of oil per day in 2023 and 42 million gallons per day in 2024. The United States is expected to account for about half of the forecast growth, which is significant given that US production had been slow to recover immediately after the pandemic.

Other countries in North America, South America, and Western Europe are also expected to significantly increase production in 2023 and 2024. This means that countries such as Canada, Brazil, and Norway will be producing more oil and natural gas liquids than they have in previous years. This increase in production is expected to offset production cuts announced by OPEC+, the group including OPEC plus several other major oil producers, in April.

However, there is some uncertainty around the forecast due to factors such as global economic growth, Russia’s production, and possible delays in expected project start-up dates. This means that the actual increase in production may be different from what is predicted in the report.

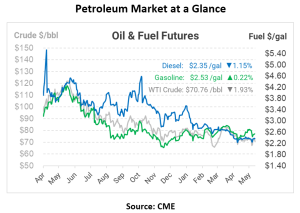

Overall, the shift of production growth from OPEC to non-OPEC countries is a significant development in the world energy market. The move means less price control power for OPEC, which could perhaps mean more volatility (lower lows, higher highs) in the years to come. It will be interesting to see how this trend develops in the coming years and what impact it will have on the price of oil and natural gas.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.