Saudis Cut 1 MMbpd of Oil, OPEC+ Makes No Change

Oil prices are moving higher this morning following the OPEC meeting yesterday, during which Saudi Arabia announced they would be unilaterally cutting production by an additional 1 million barrels per day. Although the OPEC+ alliance chose not to change their existing production cuts set in April, Saudi Arabia acted on its own to provide upward pressure for prices. The cuts will last at least a month, though Saudi Arabia noted that the cuts may be extended in the future.

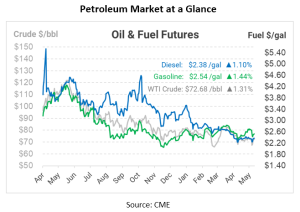

Although physical supply markets remain below their 5-year averages, trading sentiment has weakened over the past few months, leading WTI crude oil to decline as low as $67/bbl last week. But the Saudi cuts have caused some analysts to recalculate. Oil and fuel prices are trading higher this morning, and calls for $100/bbl oil in the second half of the year are mounting. Major banks expect stronger Chinese demand, tight production, and low inventories to combine later this year to cause an oil price rally.

Some are calling Saudi Arabia’s solo cuts a “failure” of the kingdom to marshal support among OPEC+ members, which would suggest that existing cuts could unravel and lead to higher production. On the other hand, some say the unilateral move adds credibility to bullish scenarios since the kingdom doesn’t need consensus to drive prices higher. Either way, the move is pushing prices higher this morning, since the market hadn’t expected any changes during the OPEC meeting. Heading into the meeting, Saudi Arabia had warned short sellers of an “ouching”, but other member countries signaled they would not change their production.

OPEC+ did not change their production cap this year, but they did extend cuts to next year (including a “paper” reduction of 1.4 million barrels compared to this year) and reshuffled 2024 quotas among members, which will ultimately allow more production on the scene next year. Some members have been unable to produce enough oil to get to their cap, while others were held below their total capacity. The changes will lower the cap for countries unable to hit their goals while increasing quotas for countries with more spare capacity. For instance, the UAE’s output target was increased by 200 kbpd next year. This shuffling will dampen the impact of Saudi Arabia’s unilateral decision.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.