Natural Gas News – August 3, 2023

Natural Gas News – August 3, 2023

Subdued Outlook as US Gas Demand Battles Rising Output

US natural gas futures are edging higher on Thursday as traders brace for the weekly government storage report. Following a test of its lowest level since June 15, a fall propelled by a decrease in demand over the upcoming two-week period and a surge in output, futures are now pushing upwards. Even though the price drop persists, forecasts predict the continuation of the heatwave, particularly in Texas, until mid-August. Contrary to expectations, the record high temperatures and unparalleled power generation demand have failed to instigate a rally in the market. This is due to robust production numbers within the US. A slight movement upwards is predicted, but no substantial shift in either direction is expected despite the escalating power demand in Texas. For the third day in a row, the power demand in Texas…

The Commodity Natural Gas Bulls Need Most: Patience

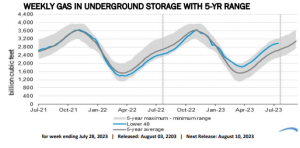

The weather in the U.S. couldn’t be any hotter, especially in the South-Central region. Air conditioners are being cranked to the hilt day and night. Yet, natural gas prices aren’t going north but south because supplies are, somehow, adequate to keep up with the maddening heat and power burns. But that could change in due course, we hear, to the benefit of the longs. Thus, the only real commodity gas bulls probably need now is that thing called patience. Veteran market analyst Eli Rubin, in an articulation of the aforementioned point, points to undergone caverns in naturally-occurring salt domes in the U.S. South-Centre where gas is stored. According to him, last week’s draw of 11 billion cubic feet, or bcf, from south-central salts caverns despite tame physical market pricing “may…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.