Week in Review – August 4, 2023

Crude oil futures are up this morning, with a rise of 30c/bbl. Both Brent and WTI are currently on course to record consistent increases for the sixth week in a row, a streak not seen in more than a year. Brent and WTI both managed to close $2/bbl higher yesterday, following Saudi Arabia’s announcement to extend its 1mb/d production cut through September and Russia’s pledge to continue cutting production into the same month. These announcements have led to bullish sentiment in the crude market ahead of today’s online review involving key OPEC+ members.

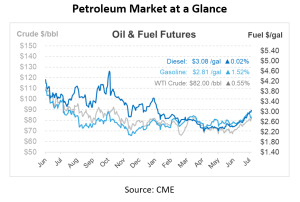

Oil prices witnessed a significant surge of over 14% in July compared to June, marking the highest monthly percentage increase since January of the previous year. This uptick is a result of a tighter supply and increased demand, which overshadowed concerns over potential interest rate hikes and persistent inflation that could impact economic growth.

Earlier today, an OPEC+ ministerial panel convened but did not modify the group’s current oil output policy. Saudi Arabia, the leader of OPEC, announced yesterday its plan to extend a voluntary oil output cut of one million bpd into September. It also hinted at the possibility of extending the cut beyond this period. The group’s output cuts, excluding the additional voluntary reductions from the three producers, are estimated at 3.66 million bpd, approximately 3.6% of the global demand. Continuing with its supply cut pledge, Russia has announced that it will further reduce oil exports by 300kb/d in September. This follows two previous commitments to cut supply by 500kb/d.

Goldman Sachs has improved their nowcasting model for Russian oil production, a key determinant of how tight the oil market will become in the coming months. Goldman estimates that Russian total liquids production has declined to 10.7mb/d, down 600kb/d since February, given a significant decline in seaborne crude exports to India. Given these factors, if Russia further reduces output by 500kb/d, it is likely that Brent would reach $98/bbl in 2024 Q3, $5 above GIR’s baseline of $93/bbl, presenting a moderately bullish upside price risk.

Prices in Review

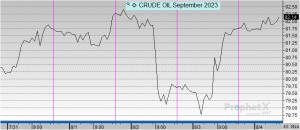

Crude opened the week at $80.65 and witnessed up-and-down swings most of the week. This morning, crude opened at $81.73, an increase of over $1 or 1.34%.

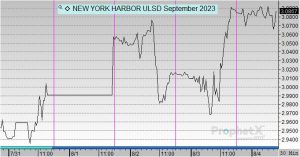

Diesel opened the week at $2.9558 and saw steady increases throughout the week. This morning, diesel opened at $3.0852, an increase of nearly 13 cents or 4.38%.

Gasoline opened on Monday at $2.938, experiencing slight decreases for the week. This morning, gasoline opened at $2.7780, a decrease of 16 cents or -5.45%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.