Natural Gas News – July 18, 2023

Natural Gas News – July 18, 2023

European Natural Gas Prices Plunge As Norwegian Supply Rises

Europe’s benchmark natural gas prices extended last week’s losses to drop by nearly 3% midday in Europe on Monday after a prolonged maintenance period on a key Norwegian gas supply route ended this weekend. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, traded at $28.32 (25.22 euros) per megawatt-hour (MWh) as of 11:57 a.m. GMT on Monday, down by 2.84% on the day. Last week, Europe’s gas prices posted their biggest weekly loss for this year, 22%, as Norwegian gas supply increased following the end of regular maintenance at the giant Troll gas field and several other gas processing plants in Norway. Over the past month, maintenance at some facilities had to be extended beyond the original end date, which caused volatility in the gas market due to uncertainty about the Norwegian…

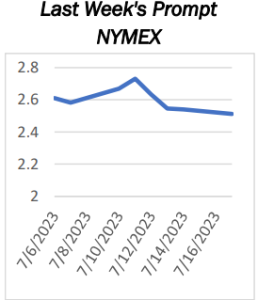

Natural Gas Price News: XNG/USD Regains $2.53 Amid Fears

Natural Gas Price (XNG/USD) seesaws around the intraday high of $2.53 as it clings to mild gains during the first positive day in five amid early Tuesday. In doing so, the energy asset justifies the market’s fears of the European gas crisis while cheering the broad-based US Dollar weakness. However, headlines suggesting more gas supplies from Norway prod the XNG/USD bulls. Although Europe has filled ample gas reserves to battle the winter, the International Energy Agency (IEA) cites the odds of witnessing a fierce problem for the old continent if Russia stops its supplies to the bloc. “The IEA said that even if Europe’s gas storage sites are filled close to 100% of capacity before October — the expectation of which has helped lower prices in recent months — that was ‘no guarantee’ against …

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.