Crude Sneaks Higher on Global Oil Production Concerns

Crude futures inched higher this morning with a 20 cent/bbl increase from yesterday. Equity futures are little changed while the US dollar is experiencing a downturn as we approach the crest of the second quarter earnings.

Following the recent China GDP data that fell short of expectations, crude dipped by $1.30/bbl yesterday. The drop was further influenced by the resumption of Libya’s oil production, which had been stalled due to political unrest. Protestors had prompted a shut-in following the kidnapping of a former finance minister, resulting in a significant disruption to the country’s output. Two out of the three Libyan fields that were closed last week are now back in action, signaling the outputs are no longer a global concern.

On the flip side, Chinese oil demand has surged 14% year-over-year, as reported by Bloomberg. Goldman Sachs Investment Research (GIR) also highlights the ongoing uptick in manufacturing activity. This has helped crude prices rally in July, primarily due to the extended Saudi oil cuts and additional cuts made by Russia. Goldman Sachs has also revised their recession risk prediction down to 20% (a 5% decrease from their previous 25% forecast). This revision comes in response to recent macroeconomic indicators showing inflation rates in a more palatable range than previously predicted.

Russia’s seaborne crude flows have dwindled to a six-month low, a significant 760k bpd reduction from their May peak. This decline has led India to open discussions with Middle Eastern oil exporters about diversifying its crude supply away from Russia.

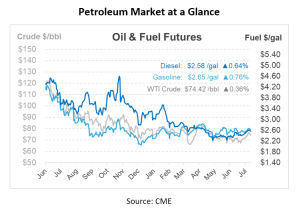

In the refining sector, both gasoline and product cracks have seen an increase of approximately 50c/bbl, building on their gains from the previous day. As the U.S. navigates through the summer season, gasoline cracks trade at about $2/bbl from their year-to-date highs, with unforeseen outages and tight supply conditions bolstering cracks.

Market insiders eagerly await industry data set for release later on Tuesday, which is forecasted to reveal a decline in U.S. crude oil stockpiles and product inventories from last week. The U.S. shale oil production is projected to experience its first monthly decrease since December 2022, according to data from the Energy Information Administration released on Monday. This may signal a turning point, indicating possible shifts in the landscape of global oil production.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.