Oil Prices Retreat on Threats of Further Rate Hikes and Muted Oil Forecasts

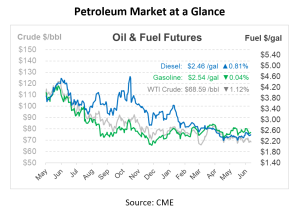

Oil prices retreated this morning, awaiting new data that could offer insight into the U.S. fuel consumption habits during the summer driving season. Brent crude exhibited signs of retreating bulls, as its price structure began to decrease. Crude oil prices have maintained an approximate $10/bbl range since May. This can largely be attributed to the rather muted supply and demand forecasts.

Policymakers in the United States last week were hawkish on interest rates, pointing to the potential for further hikes. The overture was felt across the Atlantic where European Central Bank (ECB) President Christine Lagarde conceded that the stubborn inflation is overstaying its welcome, mandating the bank to hold back from crying victory over rate hikes. Heightened interest rates often add pressure on economic recovery, consequently impacting oil demand.

In an unexpected twist yesterday, crude prices, particularly WTI and Brent, experienced an upswing of about 70 c/bbl. This temporary spike came about after Chinese Premier Li Qiang offered a glimpse into the government’s intent to introduce more initiatives to spur domestic demand. Prices soon dropped over $1/bbl from the morning’s pinnacle of $70.15 and $74.90, respectively. These remarks from Premier Li Qiang echoed prior sentiments from other Chinese officials, and the market perhaps saw through this.

The Brent market structure has unraveled a scenario known as six-month backwardation, which is now at its feeblest since last December and is barely positive. This suggests that traders are exhibiting dwindling concerns about potential supply shortages. Additionally, the two-month spread unveils the market inching into a shallow contango, hinting at a possibly oversupplied market.

In the Caribbean, Guyana, a rising star in the crude production universe since 2019, received an invitation to OPEC’s seminar in July. Although not a golden ticket to OPEC membership, it’s still noteworthy. The Guyanan Vice President was prompt to clarify that joining OPEC isn’t on their agenda. Instead, Guyana is preparing to host an oil auction, aiming to allure oil and gas giants for a discussion of production opportunities.

The amount of oil stored at sea has surged to levels not seen in over two and a half years. This phenomenon has largely been propelled by an abundance of Saudi barrels freighting in the Red Sea. The volumes stored grew to a staggering 129 million barrels in the week culminating on June 23rd. Storage volumes in Asia were surpassing 11-month highs, while the Middle East boomed with the highest since January. This maritime stockpile has been gaining momentum, although the total oil at sea, inclusive of barrels in transit, has been receding, partly due to a dip in crude transport following a contraction in OPEC+ production.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.