Natural Gas News – June 27, 2023

Natural Gas News – June 27, 2023

Natural Gas Forecast: Rising Demand Eyed as Texas Faces Record-Breaking Electricity Use

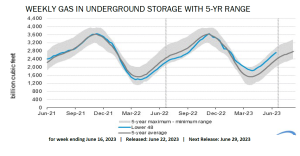

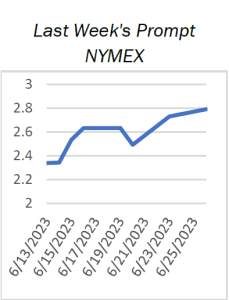

U.S. natural gas futures are experiencing a slight decline on Tuesday after reaching their highest level in over three months the previous session. The increase in demand was primarily driven by expectations of rising demand for liquefied natural gas (LNG) exports and soaring temperatures, particularly in Texas, as they anticipated to boost cooling demand. The number of oil and natural gas rigs operating in the country has been steadily decreasing for eight consecutive weeks, signaling a pullback in drilling activity. Additionally, data provider Refinitiv predicts a rise in demand for LNG exports, with estimates indicating an increase from 11 billion cubic feet per day (bcfd) to 11.5 bcfd this week and further to 12.6 bcfd next week. Forecasts also indicate an increase in cooling demand, with the number of cooling…

Europe’s Natural Gas Prices Rise On Abnormally Warm Summer

Europe’s benchmark natural gas prices continued to rise early on Tuesday as weather forecasts suggest that most of northwest Europe, the biggest consumers of gas, will see a hotter-than-usual start to the summer, at least until the middle of July. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, have risen in recent days, due to maintenance on Norway’s gas processing plants and some offshore gas fields, and this weekend’s brief revolt by the Wagner mercenary group in Russia. As of 10:23 GMT on Tuesday, the Dutch TTF July contract had risen by 2.2% and traded at $35.75 (32.67 euros) per megawatt-hour (MWh), which was much higher than the 25 euros/MWh from three weeks ago. As traders focus on the potential of higher demand due to hot weather, they are also…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.