Natural Gas News – June 2nd, 2023

Natural Gas News – June 2nd, 2023

US Natgas up 2% on Forecast for More Demand, Record Exports to Mexico

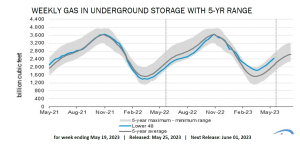

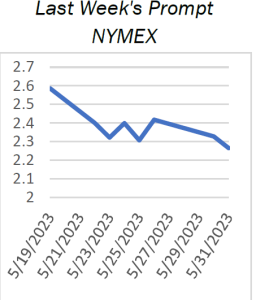

U.S. natural gas futures rose about 2% on Friday on forecasts for more demand over the next two weeks than previously expected and record exports to Mexico. The price jump occurred despite near-record U.S. output and continued low amounts of gas flowing to U.S. liquefied natural gas (LNG) export plants due to maintenance. Front-month gas futures for July delivery on the New York Mercantile Exchange (NYMEX) were up 4.5 cents, or 2.1%, to $2.203 per million British thermal units (mmBtu) at 9:01 a.m. EDT (1301 GMT). On Thursday, the contract closed at its lowest level since May 5. That put the contract up about 1% for the week after it lost about 16% last week. With growing interest in energy trading, open interest in NYMEX gas futures rose to 1.387 million contracts on Thursday, its highest number since September 20…

US Natgas Futures up 2% to 1-Week High With Warmer Weather Coming

U.S. natural gas futures rose about 2% to a one-week high on Wednesday on forecasts for warmer than normal weather in mid-June that should boost air conditioning demand. That price increase came despite record U.S. output, lower gas flows to liquefied natural gas (LNG) export plants due to maintenance and rising gas exports from Canada after wildfires caused some energy firms to shut-in production earlier in the month. Front-month gas futures for July delivery on the New York Mercantile Exchange rose 3.5 cents, or 1.5%, to $2.362 per million British thermal units (mmBtu) at 8:57 a.m. EDT (1257 GMT), putting the contract on track for its highest close since May 24. Despite price gain on Wednesday, the front-month was still on track to decline about 2% in May after gaining about 9% in April.…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.