EU Sanctions Go Live: Implications for Markets

Yesterday, the implementation of the EU sanctions on Russian refined products took effect. The fuel market is actually trading lower, a sign that markets have already priced in any short-term supply disruptions. Europe has been importing significant diesel volumes, restocking to ensure they can get through the winter. Warm weather has helped prevent heavy demand spikes. With adequate inventory levels for now, expect diesel markets to be calmer in the short-term.

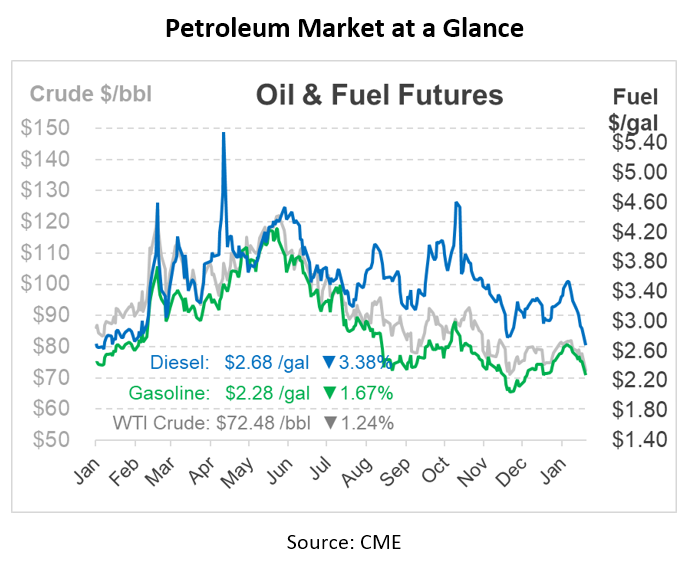

Although the market is calm today, there’s still a structural shortfall of diesel production that will weigh on markets this year. While diesel prices have fallen substantially recently, they remain more than 40 cents higher than gasoline. And despite diesel crack spreads (a refiner’s profit from converting a barrel of crude into a barrel of diesel) being near their lowest level in the past year, spreads remain almost double what they were pre-2022. It’s clear the market still considers diesel supplies to be tight – and we could occasionally see temporary tightness like that experienced in April and November last year.

The EU decided on Friday to set price caps for Russian fuel products that trade at a premium to crude, setting a limit of $100/bbl ($2.38/gal). For low-quality products that trade at a discount to crude, the limit is $45/bbl ($1.14/gal). There is a grace period until April for cargoes that were loaded for export before the cap was decided. A review of the $60/bbl price restriction for Russian crude oil will now be delayed until March when regular two-month evaluations of all cap levels will begin.

Due to the sanctions on Russian oil exports, which caused a decline in the price of Russia’s flagship crude grade, budget revenues from oil and gas fell by 46% in January compared to the same time last year. As the discount to Brent widened, the price of Russia’s premium Urals grade was, on average, 42% cheaper in January 2023 than in January 2022.

Russia is seeking methods to stabilize its oil revenues and reduce the deep discount for Urals crude. Russian President Vladimir Putin issued an order at the end of last month for the government to propose ideas in a month’s time to alter the way oil taxes are calculated. According to a report published last month by the Centre for Research on Energy and Clean Air (CREA), the EU embargo and price cap are costing Russia approximately $174 million per day. CREA also anticipates the income losses to increase to $304 million per day with yesterday’s implementation of sanctions.

According to Goldman Sachs, oil is expected to once again surge beyond $100/bbl this year and potentially face a significant supply issue in 2024 as extra production capacity dwindles. While prices are hovering at $80/bbl currently, prices could spike as sanctions are projected to force Russian supplies to decline, and Chinese demand is anticipated to recover as the COVID policies stop.

Over the past few years, oil prices have been nothing shy of unpredictable, dipping to around $20/bbl during the pandemic and then recovering to nearly $130/bbl after Russia’s invasion of Ukraine damaged an already weak supply. As we continue throughout this year and look ahead into 2024, be cognizant of potential volatility as a continued result of the EU embargo and uncertainty with Russian policies.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.