Week in Review – February 3, 2023

With the expiration of monthly fuel contracts this week, the market has turned from February futures contracts to March. The transition brought a cooler market, with crude oil dipping down to $76 this week while diesel is trading below $3/gal for the first time since early January. But that slowdown doesn’t give the full picture – regional supply challenges have presented local supply challenges. Add the upcoming embargoes on Russian oil – there’s plenty of uncertainty under the surface.

In Texas, winter storms have knocked out power to over 400,000 people this week. The icy conditions slowed deliveries, causing delays in fuel orders. Colorado and the surrounding area continue facing supply challenges due to the state’s refinery outage. Up in Ohio, refinery maintenance has also caused supply tightness.

Markets are closely watching the EU, where embargos go into effect on Russian fuel products on Sunday. Although markets expect Saudi diesel to fill most of the gap, that means less diesel flowing to other customers. US diesel exports could increase if Russia’s 800 kbpd typically sent to the EU cannot find another home.

The EIA’s report on Wednesday was a big contributor to the downturn; they posted across-the-broad builds of crude, diesel, and gasoline inventories. Given the market’s expectation of a diesel draw, the surprise build was considered bearish.

Several important meetings this week brought key decisions. OPEC+ agreed to maintain their current production levels, taking a wait-and-see approach. Between China reopening, EU embargos, and potential economic slowdowns, OPEC has a lot to monitor.

In the US, the Federal Reserve hiked interest rates by .25% on Wednesday, in line with expectations. The increase represents a deceleration in the Fed’s rate hike schedule. Two more .25% hikes are expected in March and May. The market views these interest rates two ways – on one hand, interest rates mean less borrowing and reduced demand, so lower fuel prices. On the other hand, if the market expected even higher interest rates, then they may see the .25% hike as bullish for prices.

Prices in Review

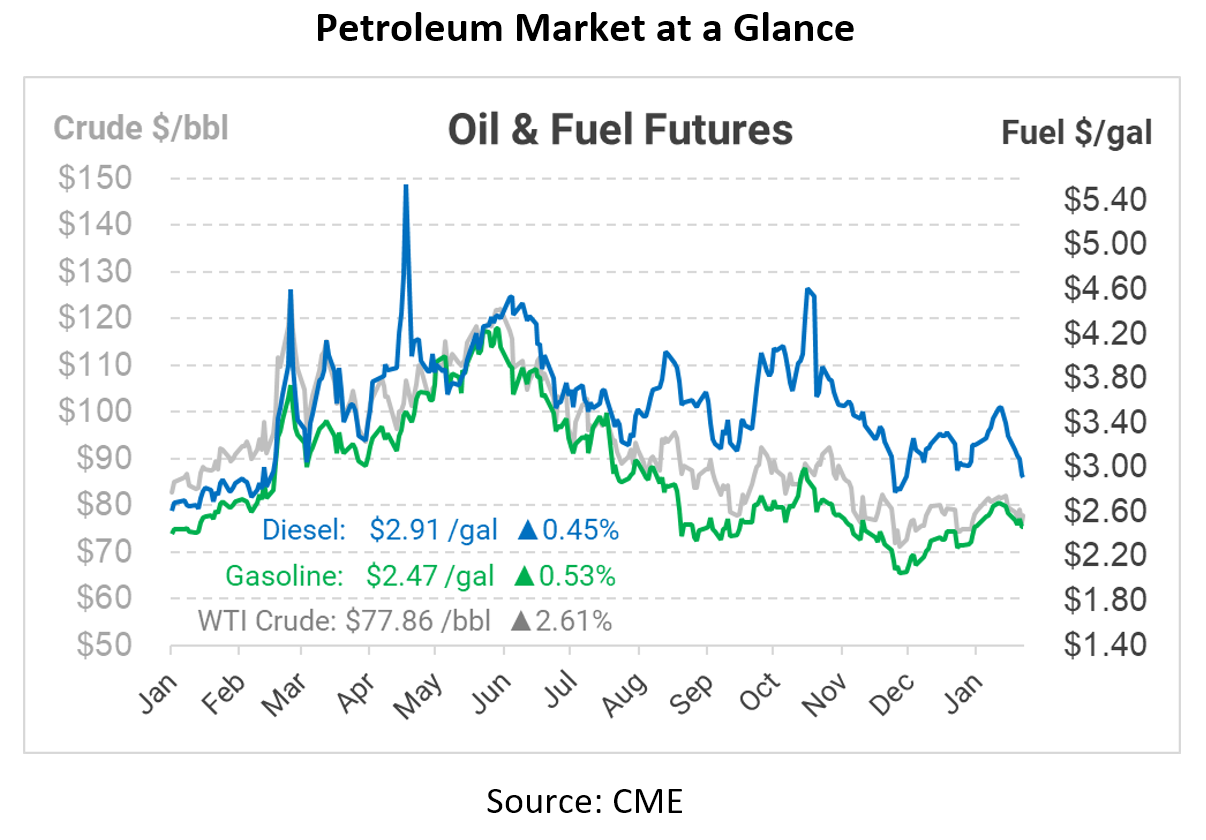

Crude oil began the week at $80.04 but quickly turned lower, ending Monday below $78. Prices continued sinking, taking a large turn downward on Wednesday. This morning, crude oil opened at $75.92, a loss of $4.12 (5.1%).

Diesel prices have trended mostly lower throughout the week, save for a brief jump on Tuesday. Prices opened the week at $3.2816, but fell below $3/gal on Wednesday. This morning, diesel opened at $2.9061, a loss of 37.6 cents (-11.4%).

Gasoline is also lower this week, though not quite as much as diesel markets. Prices opened at $2.5860, falling to $2.4529 this morning. That represents a loss of 13.3 cents (-5.1%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.