What Is It – Brent-WTI Spread

All crude oil is not made equal. Virtually every producing country has its own unique blend of crude that it trades – from Western Canadian Select to Saudi Arabia’s Arab Extra Light. They each have their own unique price based on quality, geography, and availability. Among all the crude contracts of the world, two stand supreme: Europe’s Brent crude oil and the US’s West Texas Intermediate (WTI) crude blend. The difference between these two oil prices – the Brent-WTI spread – is heavily monitored by traders and has a profound impact on global oil dynamics.

What Are “Brent” and “WTI”?

Brent Crude is the premier price index used globally, with nearly 2/3 of all oil traded around the world based on the Brent contract. For example, oil majors like Saudi Arabia sell their oil based on a differential to Brent Crude. Although the name originally covered oil extracted from the Brent oilfield in the North Sea, it now includes a basket of European blends from around the North Sea. The blend has been updated several times to reflect changing production trends in the area.

West Texas Intermediate is the US equivalent to the Brent contract, based on Texas oil meeting a certain specification and delivered to Cushing, OK. By contrast, Brent is deliverable to 4 different points in Europe. Because WTI contracts are specifically based on supply levels in Cushing, OK, the market reacts particularly strongly when inventories there rise or fall – even if those movements don’t reflect overall US crude inventories.

What Does the Spread Mean?

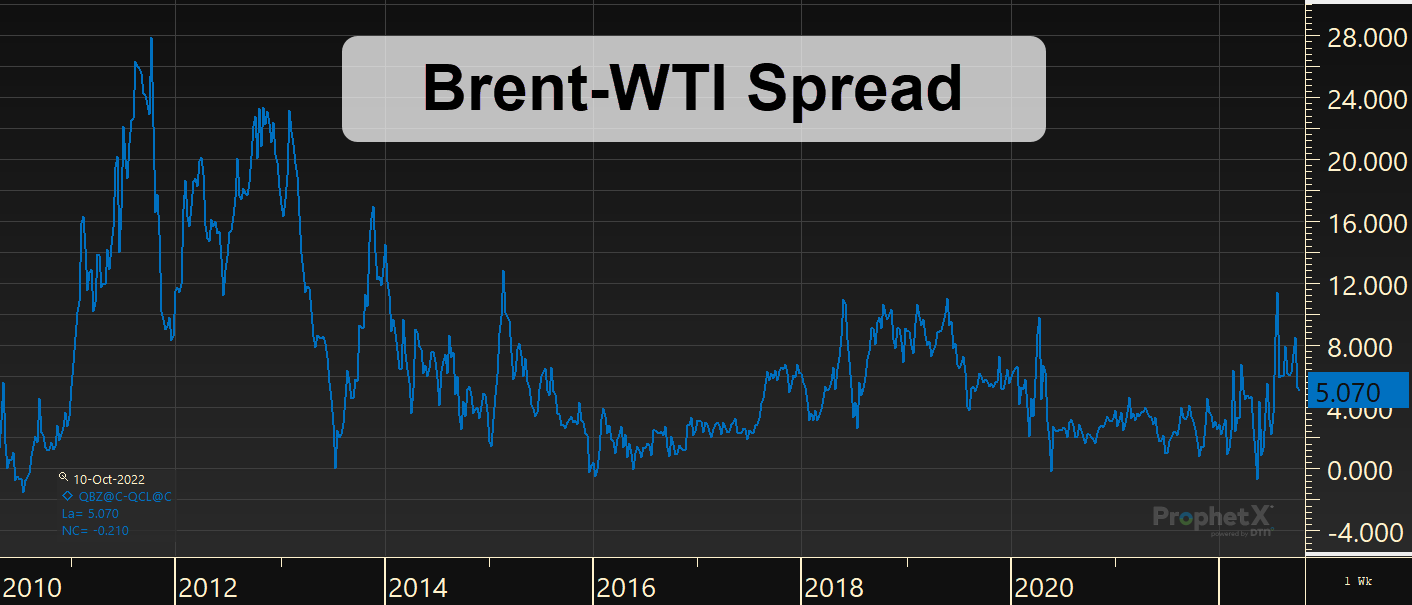

Calculating the Brent-WTI spread is quite simple – just subtract WTI crude price from the Brent crude price. Historically, the spread has been between $4-$8 for most recent history. During periods of oversupply, the spread tends to narrow; when prices are volatile, spreads tend to widen. US crude oil production has flourished since the early 2010s when fracking became a dominant extraction method. Because the US has so much supply, it tends to be cheaper than Brent – though the two products have occasionally flipped for brief periods.

How Does the Spread Impact Supply?

When the spread between Brent and WTI crude increases, suppliers see an opportunity to earn profits. By shipping crude oil from the US to Europe, traders can capture the difference in price, called an arbitrage. The spread must be high enough to cover the cost of the barge shipment – a couple dollars per barrel – as well as the logistics of sourcing and moving barrels. When the spread rises to $10-12, as it did earlier in 2022, there are ample profits to incentivize products to flow from the US to Europe. Thus, the Brent-WTI spread is always fluctuating – opening to incentivize more imports to Europe, and narrowing when supplies are sufficient.

For consumers, a widening spread typically means that US fuel prices will have to rise to keep up. Higher prices for Brent crude mean that other parts of the world, including US refiners, must bid more to secure US crude oil. That results in higher prices throughout the supply chain. Ultimately, the Brent-WTI spread is an indicator of supply imbalance between the US and Europe; however, because of the high volume of trading between them, large changes in the spread tend to close relatively quickly.

This article is part of Daily Market News & Insights

Tagged: Brent Crude, Brent-WTI Spread, Europe, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.