Andy’s Analysis: East Coast Challenges Ahead?

Analysis by Andy Milton

Today’s article is from Andy Milton, Mansfield’s Senior Vice President of Supply. Learn what’s driving the market up and down from an industry expert with decades of experience.

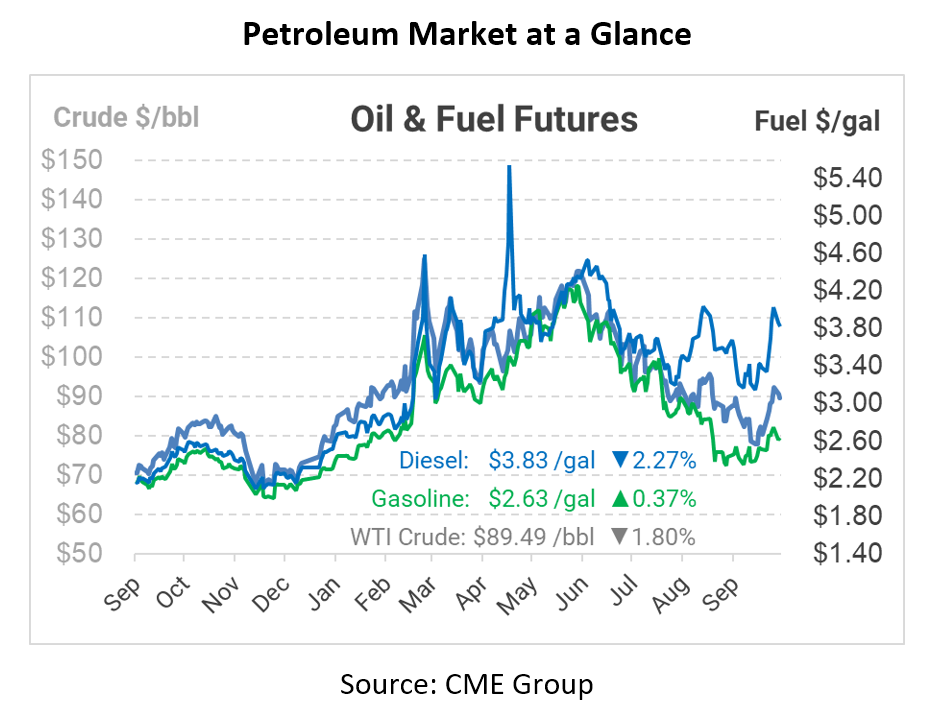

Last week, diesel was up 80 cents; this week, we’re starting down 30 cents. Meanwhile, nothing fundamentally changed in the supply & demand balance. Either way, be wary of Thursday’s DOE report (normally it’s out Wednesday, but Monday was a holiday). That DOE report should indicate the supply status.

The broker/trader talk, along with the basis indicators, are signaling the market is still very tight on the East Coast. Indicators we are monitoring:

- Some shippers have been heavily discounting fuel over the last few days. They may be dumping product rather than rolling their hedges in the backwardation. This has a short term squeeze on local price differentials, but unless shippers buy back in, the resulting impact will be incredibly tight supply down the road.

- The spread from the Gulf Coast to the New York Harbor is over 20 cents positive.

- Florida is still recovering from Ian, but instead of a knee jerk oversupply afterwards we may see a prolonged tightness as diesel bypasses Florida for NYH.

In addition, the West Coast is still 50 cents over the NYMEX for diesel, but we are unsure how long that will last.

Regarding the bigger macro situation, maybe folks woke up to the fact that OPEC was already underperforming on production, China has another renewed session of testing/potential lockdowns, and the EU is struggling with continued inflation softening demand. Either way, we start the day with a 20-cent trading range for diesel, a spread of +$1/gal between ULSD and gasoline futures, and we may be looking at some interesting volume declines in energy.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.