3 Major Reporting Agencies Slash 2023 Demand Forecast

The major oil market reports were all released this week, bringing updates from the EIA, OPEC, and the IEA. Every month, these three massive reporting agencies release a report on the state of global energy markets, including forecasts of supply and demand. So what does each agency say about the current market situation?

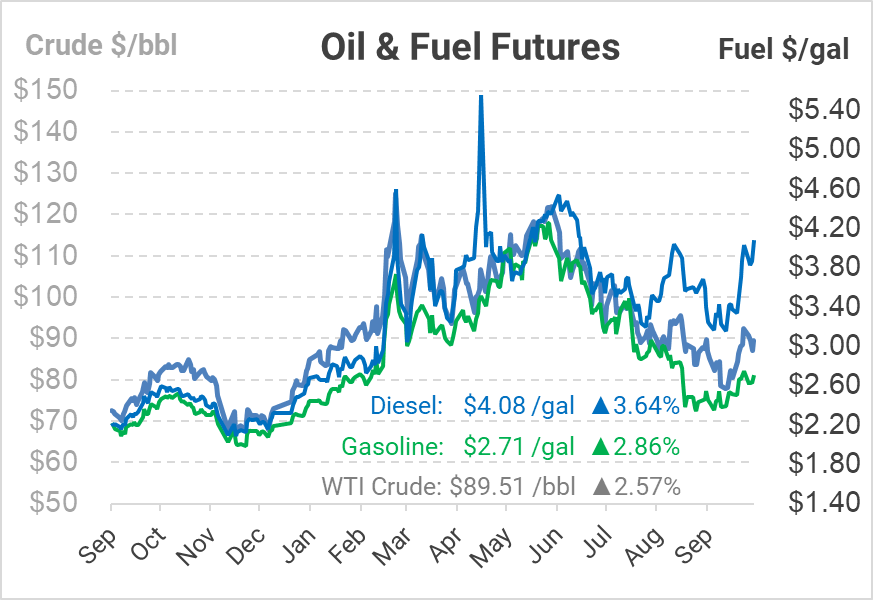

EIA: The EIA’s Short-Term Energy Outlook reflects falling supply and demand in 2023. The agency reduced its 2023 production forecast by 0.6 MMbpd due to OPEC+’s cuts as well as slow supply growth in the US. On the demand side, consumption was lowered 0.5 MMbpd due to reduced GDP expectations. Notably, the forecast included a special Winter Fuels Outlook, which notes that energy costs will rise this winter due to colder temperatures and higher energy prices. Specifically, household expenditures for heating will increase by 19% for natural gas users, 12% for heating oil users, and 8% for electric users.

IEA: The Oil Market Report shows a similar demand cut for 2023, with the agency cutting global consumption by 470 kbpd. The IEA sees the net effect of OPEC+’s cuts as half of the headline amount, decreasing supply by 1 MMbpd. Taking a global perspective, the agency notes that Russian exports have fallen moderately month-over-month; however, Europe has not meaningfully diversified its energy purchases away from Russia yet. That means embargoes could be more painful when they take place in two months. A key line from their analysis: “higher oil prices may prove the tipping point for a global economy already on the brink of recession.”

OPEC: The Monthly Oil Market Report from OPEC read as a justification of the cartel’s recent production cut. The group expects demand to fall in the future, making the cuts a proactive measure to keep prices from falling too low for comfort. As NPR wrote, “gloom oozes” from the report, which shows a variety of risk factors for the economy in the future.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.