Price Volatility – What It Means for You (Pt 2)

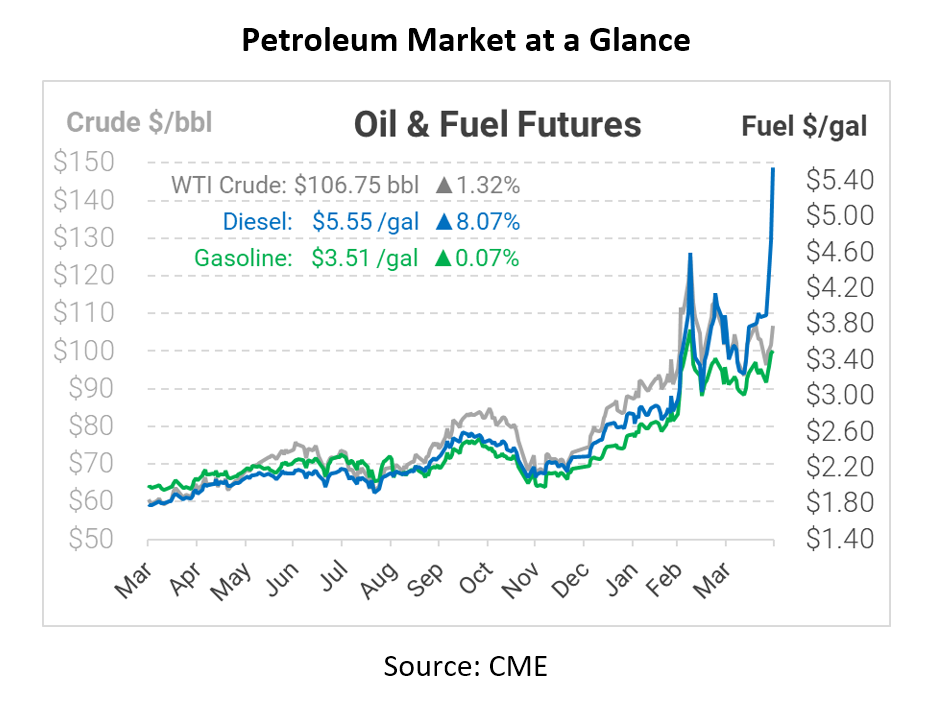

Last week, we reviewed the increase in market volatility. Fuel prices, which used to move just pennies per day, are now experiencing changes as dimes and quarters. This +350% volatility increase has a number of impacts on the fuel supply chain – and on fuel procurement teams. This week, diesel reached an all-time high over $5/gal – an astronomical level at few could have predicted entering the year.

In part 2 of our Price Volatility series, we’ll talk about four ways that volatility impacts the last mile of fuel delivery, and how fuel buyers can react.

- Supply Challenges

Extreme price swings can create supply and logistics challenges in the last mile of the supply chain. Although market prices change every second of the day, fuel suppliers typically set their rates for a 24-hour period, most commonly at 6pm local time. When prices move 10-15 cents higher, fuel suppliers can lose hundreds of dollars per load if they don’t adjust pricing mid-day; some suppliers may simply turn off their supply until markets settle to prevent losses.

With suppliers intermittently changing prices or shutting off supply, fuel trucks must work harder and smarter to keep customers fuels. Driving from one local fuel hub to another might add 45 minutes to a delivery, increasing freight costs. Although the supply may be physically available, suppliers making different decisions can create the appearance of a shortage. During major up-swings, executing on same-day deliveries may be particularly challenging. That’s why it’s important to plan ahead, order fuel at least 48 hours before a possible runout, and have a fuel supplier with numerous supply options or their own inventory to ensure you get the fuel you need.

- Price Optimization

All those price changes may not always be a bad thing. When the market drops, fuel suppliers may try to move inventory quickly, before it loses value. At the same time, this “fire sale” mentality may increase truck utilization, leaving fewer assets available for normal day-to-day deliveries. Once again, ordering in advance gives you more ability to watch the market and decide how to optimize the delivery; a same day order may be too late.

On down days, fuel buyers may be able to receive discounts on their fuel, depending on their pricing agreement. Their fuel supplier may also be able to “push and pull” loads based on the market changes, delaying deliveries when tomorrow’s price will be lower or delivering sooner when tomorrow’s price will be higher. Doing this will require close collaboration between you and your supplier, so start the conversation today.

- Budgeting

Big swings in prices can be devastating for your fuel budget, especially since most of the swings lately have been upward. If you set your 2022 budget last year when fuel prices were $2.50, it’s no surprise that you’re unlikely to come in under budget this year.

If you set your budget last year but didn’t prepare for volatility, there’s not much you can do now to get back to your $2.50 budget target. But you can implement strategies now to take advantage if and when prices fall lower. Explore risk management approaches such as price caps, which allow your price to fall with the market but caps how much you’ll have to pay if fuel keeps rising. You can also implement a long-term strategic approach in which you lock in a higher portion of your annual volume when prices are below the 10-yr average, and lock in less when prices rise above the average. Speak with a risk management expert, who can prescribe ways to ensure you hit your budget targets.

- Accounting and Inventory

For the folks in the back office, volatility can be a nightmare. How many gallons of fuel does your company have in inventory, across your storage tanks and equipment? If your company reports on inventory, $1/gal price swings can wreak havoc on your balance sheet. The changes also make it much more important to know exactly what’s in your tank – so having tank data available at your fingertips is critical.

From cash flow to inventory, make sure your accounting and finance teams understand what’s happening in the market and how it’s impacting them. Taking a multi-departmental approach to fuel strategy will make you a hero to the higher-ups at your business and potentially save your company time and dollars that you normally couldn’t save on the procurement side.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.