Week in Review – April 29, 2022

This week news of oiling hitting two-week lows, reports of summer prices to be highest since 2014, U.S. dollar increases, and airline concerns all made headlines. First, earlier in the week oil hit a two-week low due to Chinese lockdowns. In Shanghai, the world’s fifth-largest city, conditions are deteriorating as the government attempts to reign in new COVID cases. Images of buildings with newly erected fences around them are becoming mainstream, and many stores are out of essentials, including food. Almost all people living in the city have been confined to their homes, with few chances to leave. As China is the second-largest oil consumer in the world behind the United States, lockdowns will continue to reduce oil demand. China’s government seems not to be loosening up on the restrictions in Shanghai and other cities, instead making them stricter to curb disease spread.

FUELS News also reported the EIA’s summer outlook this week. “In our Summer Fuels Outlook, a supplement to our April 2022 Short-Term Energy Outlook, we expect retail gasoline prices to average $3.84 per gallon (gal) this summer driving season, April through September, compared with last summer’s average price of $3.06/gal. After adjusting for inflation, this summer’s forecast national average price would mark the highest retail gasoline and diesel prices since 2014. We expect the ongoing effects of the COVID-19 pandemic will have a smaller effect on gasoline and diesel consumption in the United States during the 2022 summer season compared with the past two summers. U.S. gasoline and diesel consumption continue to remain below their 2019 averages”.

The U.S. dollar reached a two-year high this week due to the ongoing Chinese lockdowns and Federal Reserve rate increases. Investors are flocking to the haven of the US Dollar, and higher interest rates make highly secure US bonds even more appealing. Last week the stock market fell sharply in its worst day since October 2020 as world events continue triggering uncertain market reactions. On Wednesday Russia announced a “retaliation” move: Russian energy company Gazprom would stop sending gas to Bulgaria and Poland. This has further escalated the tense situation on the border with Ukraine, with Russia now deliberately attacking opposing economies. This week, European Commission President Ursula von der Leyen stated that Russia has resorted to “blackmailing” the EU, while adding that Russian fossil fuels in Europe would swiftly be ending.

Lastly, due to supply concerns many airlines are taking major hits. The biggest expense for airlines behind labor is the fuel they consume. With oil prices up around the globe, the airlines must make up higher costs by pushing their ticket prices higher as well. Recently Delta President Glen Hauenstein said that the company must raise rates by “$30 or $40 per ticket” to help offset prices. This is bad news for travelers, as sometimes airline companies are even cutting flights the same day in order to preserve cash and prevent losses.

Prices in Review

WTI Crude opened the week at $101.38. Prices dropped briefly earlier in the week before climbing back up. Crude opened Friday at $105.17, an increase of $3.79 from Monday.

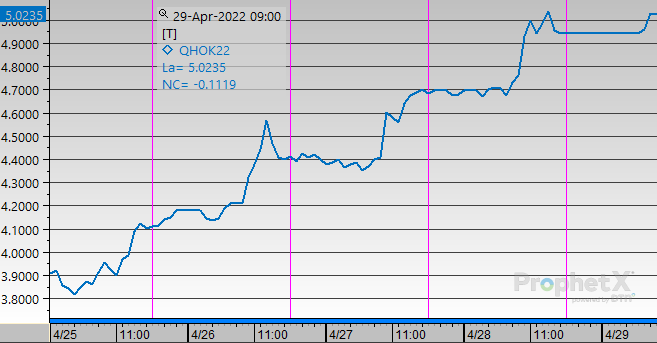

Diesel opened the week at $3.9544. Different from crude, diesel moved up steadily throughout the week before hitting an all-time record high on Thursday and Friday. With diesel trading steeply above $5/gal this morning, markets are reeling to find enough diesel around the world to meet demand. Since diesel is fundamentally tied to economic growth, this new peak is frightening for future economic growth.

Gasoline opened the week at $3.2986. Prices briefly dipped before gaining again through the week. Gasoline opened today at $3.4709, an increase of $0.1723 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.