European Union Talks Hint Toward Russian Crude Ban

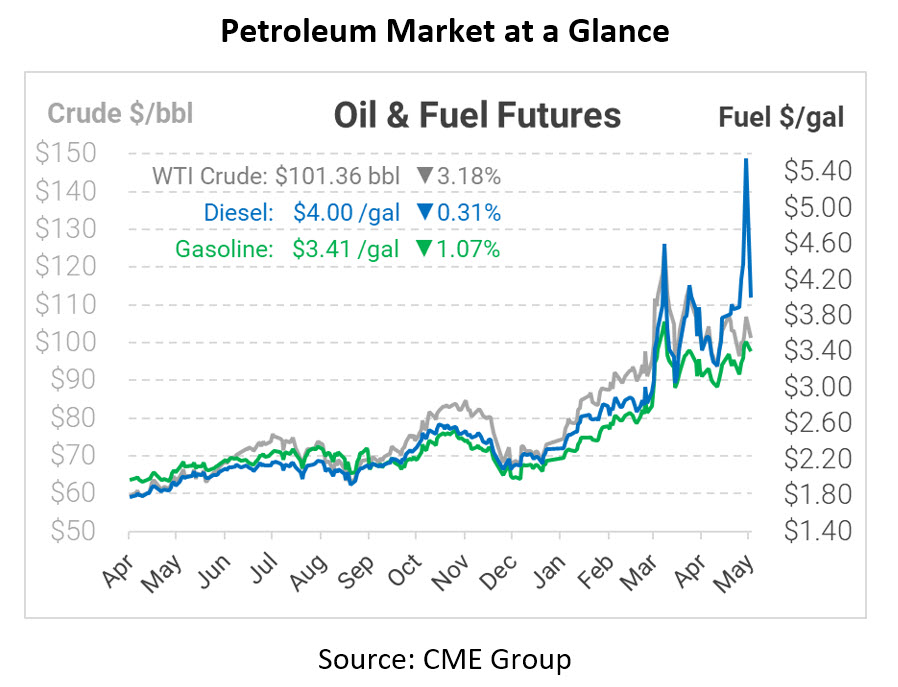

After a wild week that saw diesel prices skyrocket above $5/gal for the first time ever, markets are cooling off a bit this morning. The expiration of the May diesel contract sent prices higher as traders scrambled to find the physical supply; now that futures are pointing towards June as the prompt month, prices have settled closer to $4/gal. A cloud continues hanging over the market as traders ponder what the EU will do about Russia. This fear of the unknown, joined with a continued Chinese lockdown and weak economic growth, makes the outlook for fuel prices more unclear. WTI crude opened this morning at $104.00. Diesel opened at $3.9940 and gasoline at $3.4350.

Over the weekend, the European Union started to lean heavily toward completely banning Russian oil imports by the end of 2022. Diplomats from the EU engaged with European Commission members this past weekend and said that this would be the likely outcome. The changing stance has mixed effects on oil – on one hand, banning Russian oil will increase pricing; however, the certainty of the timeline may actually help lower near-term oil prices.

In just a few short months the EU is now preparing a sixth sanction package for Russia, and they are slowly running out of escalation options. Of course, they could keep adding more and more sanctions, but the EU is signaling that they will accept the high cost of taking on Russia. The only way to send this message might have to come in the form of a Russian oil ban. This likely move by the EU would shake up oil markets, as around 4.7 MMbpd of crude exports are shipped to the EU from Russia each year.

The situation in China is not dissolving either, as strict lockdowns and mandatory testing remain in effect. On Saturday, Chinese officials released new data showing that factory activity is rapidly declining due to the evolving COVID-19 situation. With the world’s second largest economy under pressure, the current problems for commodity markets will continue to be felt until the COVID wave passes and the 25 million stuck inside for a month are allowed to resume their daily lives. Many officials in China believe that this month the world will start to see positive results from China, as cases are already beginning to drop. One thing remains certain – regardless of how big China’s economy is and its impact on the global economy and supply chain, their zero-COVID policy under President Xi will not deviate.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.