Oil Hits 2-Yr High, OPEC+ Maintains Cuts

OPEC+ surprised the market yesterday, causing oil prices to skyrocket at the end of the session, with gains continuing this morning. The group announced they would maintain current production levels, rather than increasing output by 500 kbpd as the market had expected. Saudi Arabia will also continue their voluntary 1 MMbpd cuts through April, keeping global crude supplies tight. Several private Canadian producers also announced planned output cuts next month, amounting to an additional 500 kbpd cut in April.

Following a volatile week filled with record-breaking EIA data, the OPEC+ decision adds yet another bullish measure. Financial markets are growing more worried that oil prices will take the same route they did in 2007 – rising quickly and triggering inflation. In turn, inflation can put a damper on economic growth, especially for developing countries whose currencies cannot keep pace with the US dollar. Fed Chairman Powell warned that inflation could rear its head, albeit temporarily, as the economy reopens. He also noted the Fed would not change rates unless the economy reaches full employment.

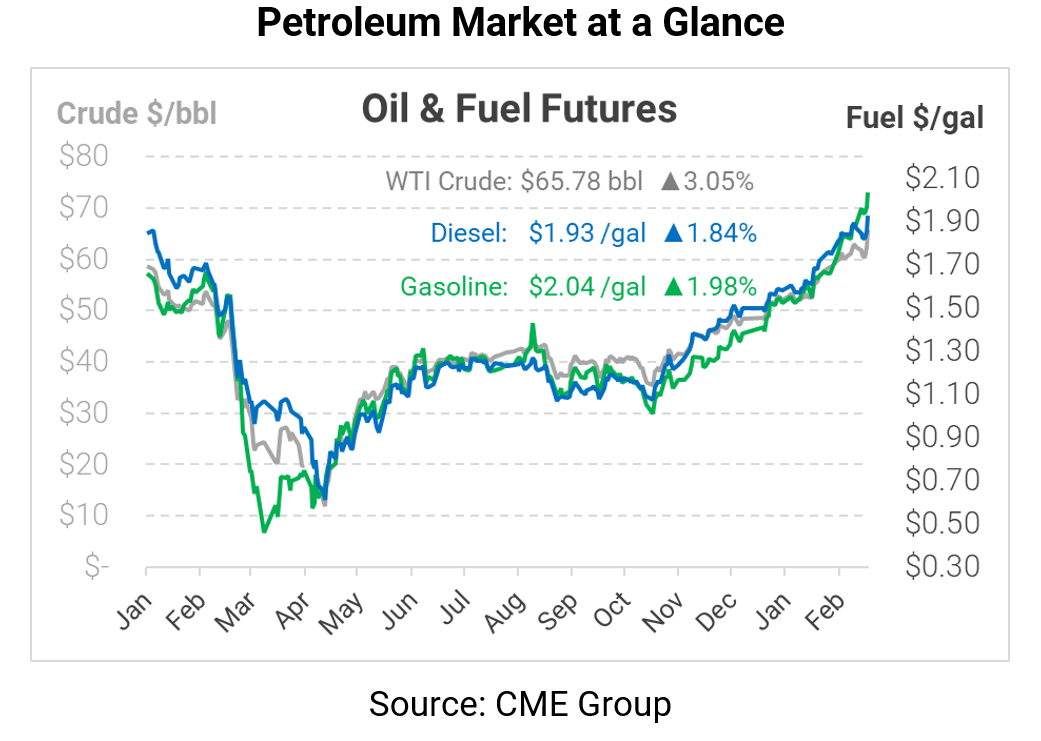

Oil prices are trading at near two-year highs this morning due to the OPEC+ restraint. WTI crude is currently trading at $65.78, gaining $1.95 from Thursday’s closing price.

Fuel prices are also sharply higher this morning. Gasoline prices is back above $2/gal for the first time since July 2019, trading up 4.0 cents to $2.0375. Diesel prices are currently $1.9308, up 3.5 cents from Thursday’s close.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.