Week in Review – March 5, 2021

It’s been a wild week for markets, with prices first falling to two-week lows before skyrocketing to fresh, multi-year highs. With on-going supply concerns in Texas, refinery utilization is at historic lows, which caused fuel prices to rocket higher. As refiners consumed less crude, a record amount of crude was added in weekly inventory gains.

Economic concerns are weighing on financial markets. As the economy recovers and demand returns, commodity prices rise, which drives up the cost of everything. As prices rise, consumers cannot afford to buy as much as before, so demand slows. To curb inflation, the Federal Reserve can raise interest rates, though so far the Fed has indicated they don’t expect long-term inflation and they will keep rates lower. Inflation tends to be bullish for commodity markets, bearish for bond markets, and mixed impacts on equities.

With the economy growing, and a $1.9 trillion stimulus on the way, demand seems to be coming online quickly. On the other hand, supplies remain tight due to OPEC+ cuts. Those factors could combine to propel oil prices much higher over the next few months – further stimulating inflation. For consumers, now is an important time to evaluate fuel prices and determine whether risk management tools are necessary to prevent missing budget targets.

Prices in Review

Crude oil prices opened the week at an elevated level – one of the highest trading prices in recent memory. Returning US production after the winter storm caused prices to fall below $60/bbl. The EIA’s surprising weekly report, filled with record-breaking numbers, turned the market around, and OPEC’s announcement sent prices soaring. Opening the week at $61.95 and opened on Friday at $64.16 – the highest in nearly two full years and a weekly gain of $2.21 (+3.6%).

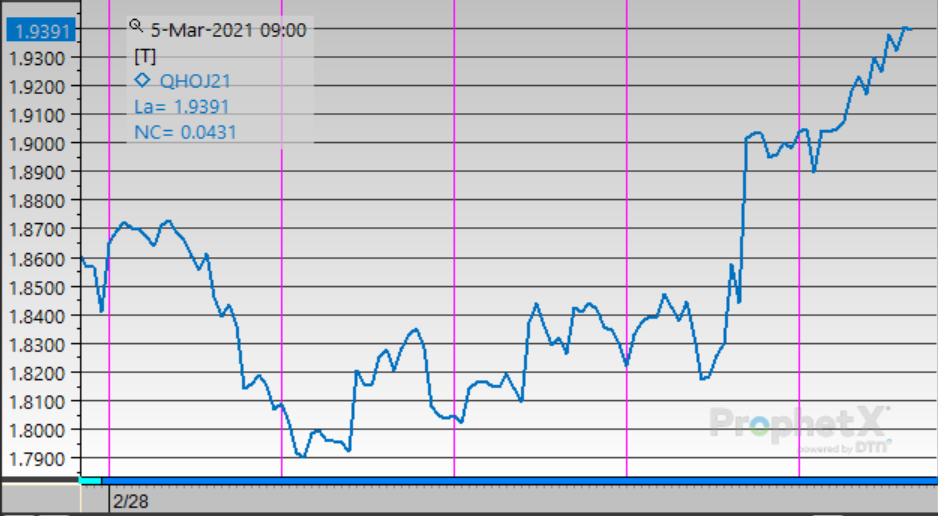

Diesel prices also soared on the OPEC+ decision, though earlier in the week they had fallen as low as $1.80. Diesel opened the week at $1.8485, climbing to open on Friday at $1.9020, a gain of 5.4 cents (+2.9%).

Like other products, gasoline prices began the week at an elevated level, fell midweek, then soared late on Thursday. Opening the week at $1.9622, gasoline opened this morning at $2.0029, a gain of 4.1 cents (+2.1%) and the highest trading price since July 2019.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.