Saudi Oil Attack Gives Brief Price Boost

On Friday, oil prices continued their relentless march higher, buoyed by OPEC+ maintaining their current production and Saudi Arabia adhering to their voluntary 1 MMbpd cuts. On Saturday, the US stimulus package cleared the Senate, heading back to the House for a second vote. Oil rose so high, the markets barely had room to move any higher over the weekend when news broke of an attack on Saudi oil infrastructure.

The attack was launched by Yemeni Houthi rebels, the same group who took credit for the 2019 attack that devastated roughly half of Saudi Arabia’s production capacity (5% of global supply). This time, there was no apparent damage to infrastructure. The attacks serve as a reminder that geopolitical conflicts can rear their head at any time. That’s particularly important now, given OPEC+’s decision to stay the course despite Texas winter storms eroding supplies. The message to the market is that OPEC+ will not ease cuts even in the face of surprise outages, implying that prices need an additional risk premium to account for supply shocks.

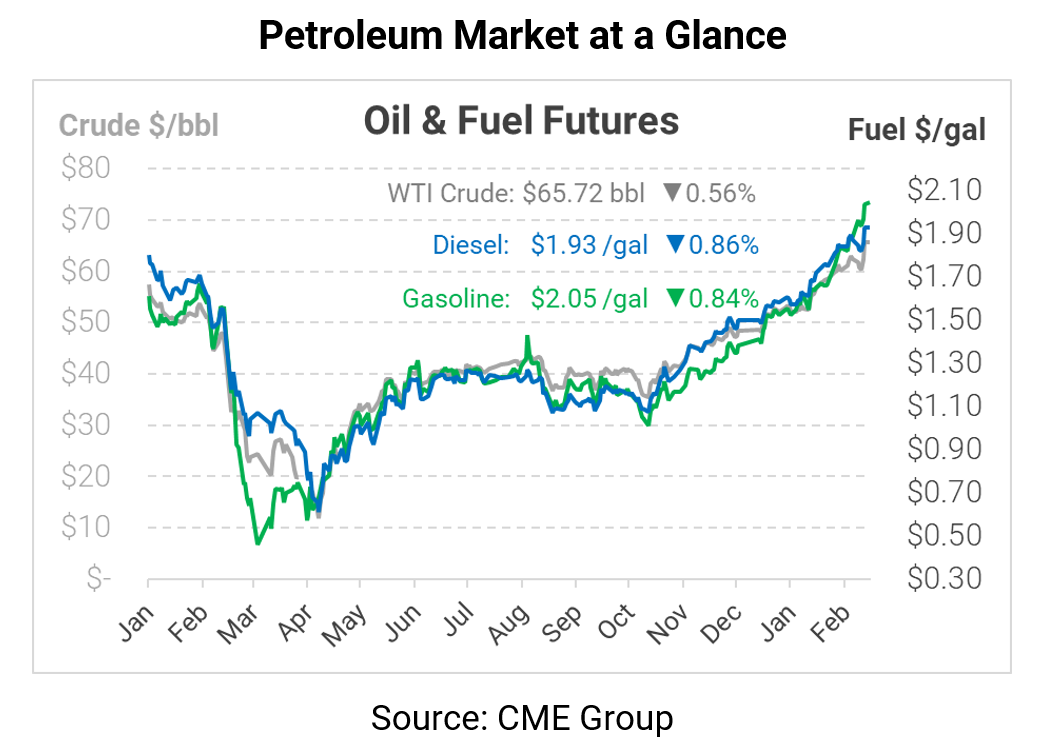

Oil forecasters have pointed to another $5-$10 price gains for oil, meaning fuel prices could rise by as much as 20-40 cents over the next few quarters. Crude, pushed excessively high on Friday, traded as high as $67.98 before falling back. Currently, WTI crude is trading at $65.72, down 37 cents from Friday’s closing price.

Fuel prices are also sinking back after huge gains this morning. Diesel traded briefly at $1.98, while gasoline soared to $2.11 at points. Currently, diesel is trading at $1.9272, a loss of 1.7 cents from Friday. Gasoline is similarly down 1.7 cents, trading at $2.0473.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.