What’s Up with These Diesel Prices?

By: Andy Milton

Happy Friday everyone! For those that don’t know me, I’m Andy Milton, SVP of Supply at Mansfield. I’m pinch hitting today on FUELSNews and I want to call out a couple of important market indicators.

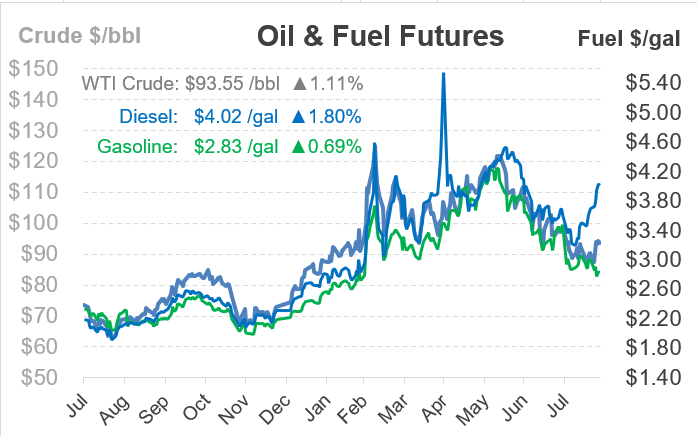

First, the graphic below shows the history and the forward market structure for gasoline and diesel futures. Simply put, this is an indication of the market participants’ belief in the value. For today’s purpose, let’s focus on the value difference (spread) between gasoline and diesel futures.

Historically, there are always some wild spreads, but currently, diesel values are much higher than gasoline. This indicates the market has some supply and demand balance concerns about diesel (as opposed to gasoline).

It’s plausible that we have hit peak gasoline demand here in the U.S. given higher prices, alternative vehicles/improved mileage, and more remote workers – even with a natural expected year-over-year increase in demand. Alternatively, for diesel, the potential convergence of higher seasonal winter diesel demand, currently low diesel supplies, and a potential EU embargo set for this winter may create a tight diesel market.

The following are leading indicators to monitor regarding the diesel market:

U.S. days of supply for diesel fuel:

- Currently hovering around 29-30 days. Ideally, this would be 35+ days, especially going into the winter.

- PADD 1 East Coast diesel inventories may even be the most important geographic indicator. Currently, inventories along the East Coast are very low compared to historical levels.

U.S. refinery production and utilization:

- Utilization is currently at 93%, which indicates higher production levels of operable refineries. The real story is U.S. refinery output, which is the total amount produced. Don’t forget, over the last 2 years we’ve closed or converted several refineries, which has essentially lowered the total U.S. refinery production.

- In 2021, U.S. net refinery production declined 12% from 2019. While there are some planned increases, there are also planned shutdowns and conversions that will likely keep production below the 2019 levels.

Either way, watch those forward market structure spreads and the indicators listed above. As always, FUELSNews can be your go-to source for market intel. I hope everyone has a safe, fun, and productive weekend.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.