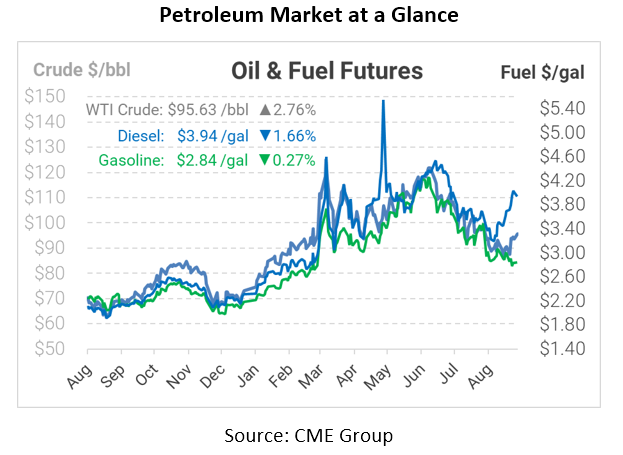

Diesel Prices Fall but Supply Concerns Remain

After rocketing up to $4/gal last week (a $.50 gain over two weeks), diesel prices are settling a bit lower this morning, though there’s plenty of room for continued supply concern. Though prices are down, that doesn’t mean that supplies are improving. Even this week, there are several challenges that fuel markets must overcome heading into the winter:

- The Northeast has critically low diesel inventories. The Biden administration has warned refiners it could take “emergency measures” if stocks do not improve and fuel continues flowing into the export market. That said, renewable fuel policies currently incentivize exports by exempting them from a refinery’s Renewable Volume Obligation, meaning they don’t have to purchase costly RINs.

- Hurricane season is gearing up, with several storms brewing in the Atlantic. Although current projects don’t show any storms hitting the US in the next couple of weeks, we’re just two weeks away from peak hurricane season. Any downtime at refineries could push fuel inventories even lower and cause prices to rise.

- A refinery outage in Indiana could impact regional supplies. The nation’s six-largest refinery, located in Whiting, Indiana, suffered a fire that limited production. The refinery has not yet published a restart date for its 440 kbpd of production capacity. Midwest diesel prices sprung up by 20 cents per gallon on the news.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.