Suez Canal Reopens – But Recovery Could Take Weeks

There’s been some good breaking news from the Suez Canal, with diggers finally getting the ship afloat. A swelling tide on Monday morning helped make the ship’s stern (rear) slightly maneuverable, and continued efforts enabled them to dislodge the bow (front) this morning. The backlog of shipping vessels numbers in the hundreds, including 35 crude tankers containing nearly 10 MMbpd. Even as the canal reopens, analysts estimate it could take a week or more to clear the backlog of vessels waiting for passage.

When comparing traffic congestion with other major canals, such as the Panama Canal, it’s easy to see why supply chains will take a long time to normalize.

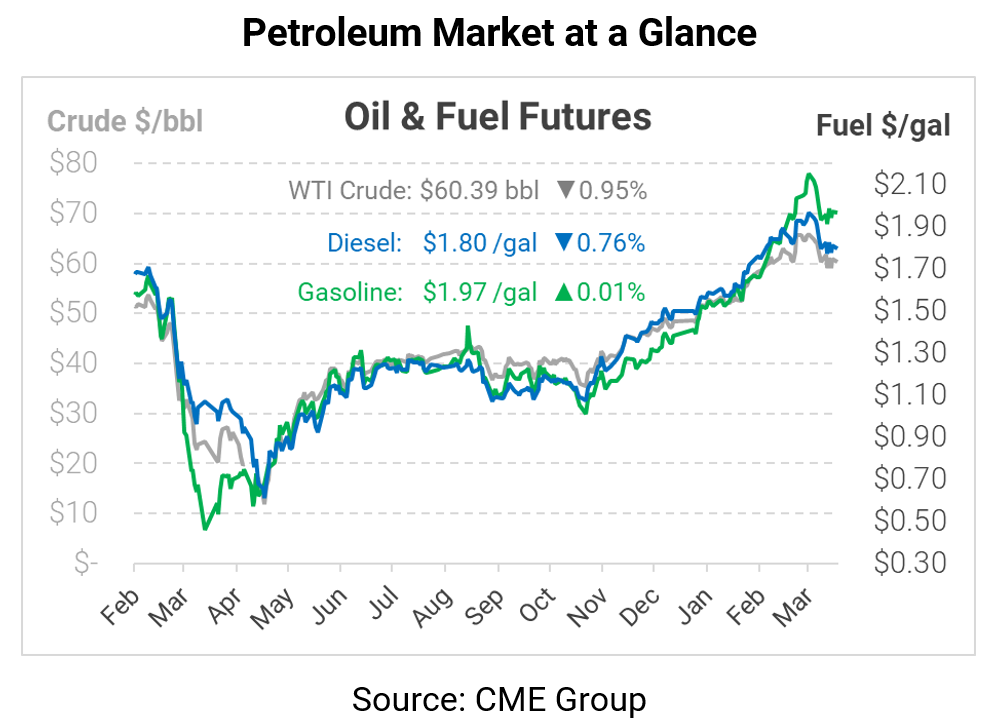

Oil markets are watching carefully for any news regarding what OPEC may due at its meeting this week. Consensus says OPEC will stay the course, which could mean a downward price correction if the group increases production. Despite volatility, WTI crude prices have persisted above $60/bbl (and Brent crude has been even higher), giving OPEC room to ramp up production if they choose.

But OPEC’s decision may yield continued cuts. Consider that a relatively small crude production hike of 1 MMbpd would increase OPEC’s total output (currently just under 25 MMbpd) by ~4%. That small output hike could conceivably cause oil prices to fall $6/bbl, roughly 10%. If that scenario occurred, OPEC would face a net revenue decline of 6.5%, while doing more work to deliver more crude. A 2 MMbpd supply increase (+8% for OPEC) would surely spook the market and might result in an even bigger selloff in the short-term. Given the math, it might make sense for OPEC to continue its existing cuts – assuming US producers do not ramp up production and flood the market on their own.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.