Saudis Support Continued Cuts

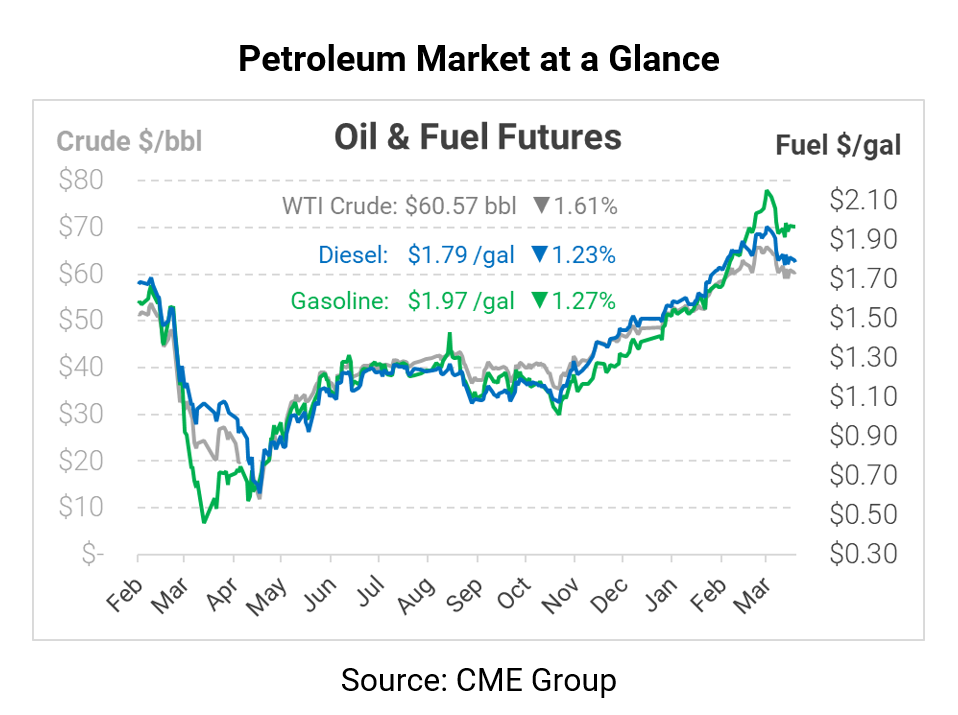

Last week’s oil volatility seems to have cooled off a bit, as yesterday brought just a 60-cent price increase for crude oil. This morning, prices are cooling off by $1/bbl but haven’t shown signs of a broader selloff. Now that the Suez Canal is open and global maritime traffic can get moving again, traders are looking ahead to OPEC’s upcoming meeting.

Yesterday, we did the math on OPEC’s decision, showing why it might make sense for the group to maintain cuts rather than increasing production. Late yesterday, Reuters reported that Saudi Arabia was pushing to extend current output levels through May and June, including their own voluntary 1 MMbpd cuts. Since the market is already pricing in no change from OPEC, don’t expect a giant rally if the organization does extend cuts.

The Suez Canal is finally open, allowing ships to flow freely through the canal. Experts suggest it could take a week or more to clear the backlog of vessels, though Egypt claims that idled ships will be able to move forward within the next three days. Either way, the effect on global shipping could last for months, given the hundreds of vessels that have lost nearly a week of productivity. In good news for North American consumers, the worst effects will be concentrated in Europe and Asia, with comparatively fewer US markets affected by the slowdown.

While shipping containers may not cause hassles in North America, the driving shortage might. In 2020, the annualized turnover rate held steady for the last three quarters, according to an ATA report. Although many expected the turnover rate to jump late in the year as shipping needs mounted, ATA Chief Economist Bob Costello noted that drivers may have been “too busy to change jobs.” Expect driver markets to remain tight in 2021, particularly given the demand boost caused by economic stimulus.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.