What Is It – SPOT Pricing

In between the NYMEX futures market, which is traded 24/7 by millions, and your local rack prices, there’s a step in between. Petroleum products like gasoline and diesel, freshly converted from crude oil, are sold by refiners into the marketplace. Typically, the products are bought by fuel wholesalers and pipeline shippers, though occasionally, some very large end-users may purchase fuel at this stage as well. We’re talking today about spot pricing, also known as cash or basis pricing, which is a critical part of the fuel supply chain.

What is Spot Pricing?

In investment terms, spot prices are the current market price of a security, currency, or commodity to be bought or sold at a specific location and time. In layperson’s terms, it’s the price sellers and buyers currently value the asset. This is different from a futures price, which is sold with a future delivery date. The biggest difference between the two pricing structures is that a spot price is set for customers needing immediate delivery, while a futures contract is set for customers that can have a delayed delivery on a predetermined future date.

For fuel markets, spot pricing represents the price of fuel coming out of a refinery before it’s been shipped to a local rack market. The spot price for fuel can be affected by a variety of factors, including supply and demand, geopolitical events, natural disasters or weather, and laws and regulations. Spot prices for fuel can be higher or lower than forward prices, as the buyer is taking on the risk of price fluctuation.

How Do Spot Purchases Work?

Spot purchases are physically traded from a storage tank, on a pipeline, or via barge and are referred to as spot because you haggle the fuel price literally “on the spot.” Trades for spot markets are usually done by direct interaction by phone or online exchanges. Spot pricing and markets are typically considered one-off deals but are standardized in several ways, such as location, transportation, and timing.

A spot market can also be referred to as the “bulk” market and is one of the most influential components in determining the prices of oil commodities. This is how gasoline, diesel, and other petrochemicals are assigned prices. This pricing index is typically in line with the futures market in regard to changes in pricing as they are large deals rather than quantified by truck loads. For example, spot purchases trades typically occur in “contracts,” which are 1,000 barrels (42,000 gallons, or roughly six truckloads). Trades may involve dozens of contracts for large buyers.

Spot deals are often made as a differential to the NYMEX. For instance, a trader buying barrels in the Gulf Coast might purchase fuel at “merc [NYMEX] -.035”, meaning the price would be 3.5 cents lower than the NYMEX fuel price. Since the NYMEX fluctuates every second, traders often use the settlement price at the end of the day as their benchmark. After the NYMEX closes at 2:30, traders settle their spot trades, eventually setting their local rack price in a given market around 6pm for the next 24 hours.

After traders have made their purchases, the average traded differential to the NYMEX (known as basis) is published by various agencies, including Platts, OPIS, and Argus. In the example above, the Gulf Coast “basis” would be -$.035 since the trade was 3.5 cents below the NYMEX. These agencies benchmark oil spot pricing and set prices for refined oil products, renewable fuels, and other types of petrochemicals derived from refineries. Although most buying and selling of crude oil and other petroleum products happen through term contracts, most contracts rely on spot pricing as the basis for their numbers. For example, Platts and Argus will assess the pricing and publish daily spot price assessments that companies will use to base term contracts.

Where are the US Spot Markets?

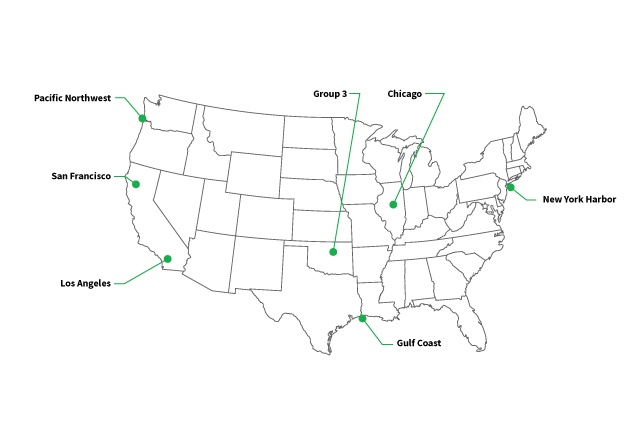

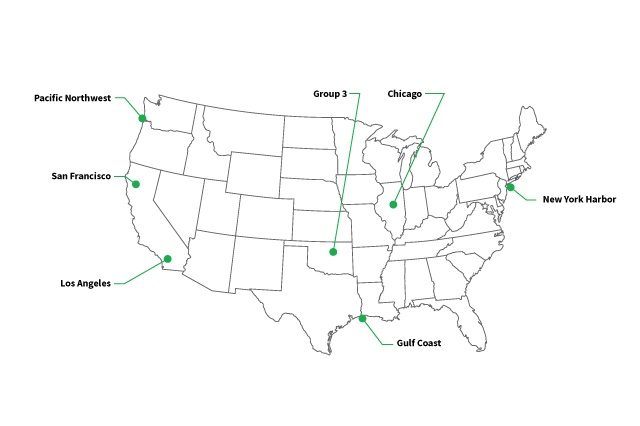

Spot prices can vary depending on time and geographical location. The spot market hubs are generally located near refineries for easy access to the product. There are several spot markets for fuel in the US. Some of the most notable include:

New York Harbor: This is one of the most active spot markets for gasoline and diesel in the nation. Located in the northeastern part of the country, prices in this market are closely watched as a benchmark for other regions. You may remember that NYMEX prices are also based on NY Harbor; the main difference between the NYMEX fuel price and a NY Harbor spot fuel price is simply the delivery timing.

Gulf Coast: The Gulf Coast is a major refining and production center for fuel in the US, making it a vital spot market for traders. Prices in the region can be influenced by factors such as crude availability from Texas and the Gulf of Mexico and the level of exports. Agencies subdivide the Gulf Coast into fuel on a pipeline and fuel on a barge (“water”).

Los Angeles: The Los Angeles spot market is a significant market for gasoline and diesel on the West Coast. This market is influenced by factors such as the level of demand from the transportation and industrial sectors. Because California is segregated from the rest of the country’s fuel pipelines, its market tends to fluctuate more due to local refinery outages or changes in fuel shipments from China.

Chicago: The Chicago spot market is a major market for fuels in the Midwest, given the many refineries in and around the area. Chicago pricing tends to be tied closely to regional demand, with Chicago diesel prices seeing volatility during the agricultural harvest season.

Who Buys and Sells on Spot Pricing?

Spot prices are typically used by fuel shippers, wholesalers, and occasionally some very large end-users of fuel. These can include retail gas stations, Fortune 500 fleets, and other businesses consuming hundreds of millions of gallons per year. Consumers will negotiate spot prices for immediate delivery or buy using a term contract tied to the daily spot price. The below consumers also take advantage of spot pricing in business dealings.

Refiners: Refineries produce fuel and sometimes need to purchase it as well if they don’t have enough stock. If they have too much stock, then they will sell off their products using spot pricing.

Traders: Traders will make bets that the market is going up or down and make drastic market decisions based on their bets.

Brokers: Brokers will match a buyer with a seller to collect a commission. They will never touch the fuel but profit from the deals.

End Users: End users can be anyone from fleets, truck stops, or even jobbers who need to supplement rack purchases with spot purchases.

Mansfield’s wholesale fuels team can assist if you’re looking to buy large volumes of fuel on the spot market. As a fuel shipper, Mansfield can also deliver your fuel to a market convenient for delivery. Mansfield offers no-obligation spot purchase options based on daily pricing. It’s simple and flexible, giving you reliable Mansfield supply with nationwide coverage.

This article is part of Daily Market News & Insights

Tagged: Argus, Mansfield, NYMEX, OPIS, Platts, SPOT Pricing, Spot Purchases, US Spot Markets

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.