Week in Review – August 19-23, 2019

For the week, the Crude Market was relatively flat. On Monday, the market was up on the news over the weekend of Yemen’s Houthi rebels drone attack. By mid-week the API reported a -3.5 MMbbls draw which was larger than expected, but the following day the EIA reported a -2.7MMbbls draw which was less than the API reported. Markets were unimpressed and traded lower.

Markets are trading lower Friday morning on the news that China announced it would impose retaliatory tariffs on $75 bn of US goods including crude and autos.

Markets continue to watch economic news such as the Fed speaking at Jackson Hole, Wyoming. The hawks had the floor until today. Chairman Powell is expected to be more dovish, and traders will be hanging on every word.

Prices in Review

WTI Crude opened the week at $54.96. It was relatively flat through the week. Crude opened Friday at $55.35, a gain of 39 cents (0.7%). In early trading Friday morning, however, the market is trading much lower, taking back those gains and more.

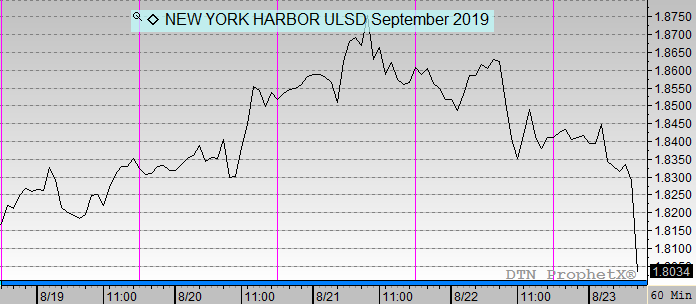

Diesel opened the week at $1.8112. It followed crude throughout the week, ending relatively flat. Diesel opened Friday at $1.8381, a gain of 2.7 cents (1.5%). Those gains have been erased and more in early trading on Friday.

Gasoline opened the week at $1.6580. It also followed crude throughout the week. Gasoline opened Friday at $1.6683, a gain of 1 cent (0.6%), but those gains have been erased this morning.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.