China Retaliates against US Commodities

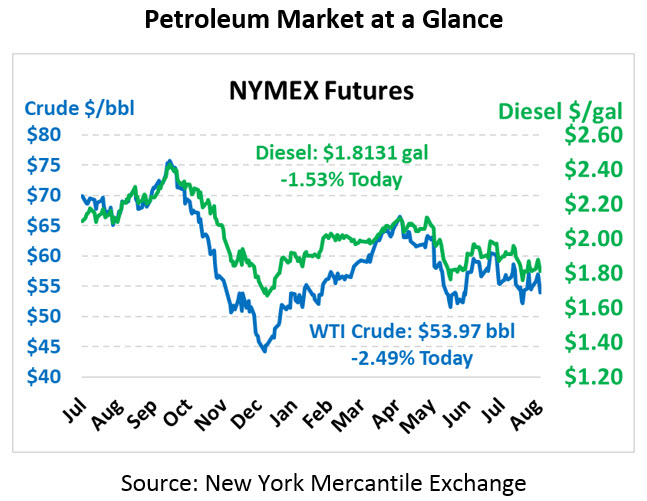

Markets are taking a huge hit this morning, led lower by WTI crude, in response to China’s escalation of tariffs on the US. WTI is taking the lion share of the hit, with WTI crude prices trading this morning at $53.97, down $1.38 (2.5%). Brent crude is trading just 88 cents (1.5%) lower today.

Fuel prices are also sinking. Diesel prices are trading at $1.8131, down 2.8 cents from Thursday’s close. Gasoline prices are at $1.6414, down 2.6 cents.

China’s recent tariff announcement on $75 billion in US goods was targeted to hit American commodities hard, applying to soybeans and oil as well as automobiles. Tariffs are set to go into effect on Sept 1, with others delayed until December – exactly like US tariffs.

The first product mentioned – soybeans – are quite important in America’s energy production strategy. Soybean prices not only impact American farmers, but also biofuel producers who must now grapple with substantially more product available in the US. For consumers, though, this is a good opportunity to reevaluate your biofuel strategy.

On the oil side, exports that have historically gone to China in the past must now find a new destination or remain in US storage coffers. It’s worth noting that since the trade war began, oil exports to China have plummeted. In the first half of 2018, exports were growing steady, peaking at 510 kbpd in June. Yet the average export level in the first half of 2019 was just 110 kbpd. That level is a blip compared to total US exports (just 3.8% of our 2.9 MMbpd exports) but has symbolic importance.

The latest shots fired by China will hurt both US agriculture and oil producers. However, global commodity markets are fluid, so tariffs from China just means suppliers will reroute from another country and ship our products their to fill the gap – at a far lower cost than paying the 10% tax. More broadly, this move continues an escalating trade war that poses a severe threat to the global economy in 2020, which ultimately is the biggest reason why oil prices are falling today.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.