OPEC+ Deal Falters, US Sells SPR Storage Space

After gaining an astounding 35% last week, crude oil prices are beginning to give back some of their gains this morning as the OPEC+ deal loses steam. Already, the OPEC+ meeting has been postponed from Sunday to Thursday, and Saudi/Russian bickering over who is at fault may derail the deal entirely. While both countries are calling for the US to join any production deal, President Trump has never hinted at the possibility, and many question whether cuts could be implemented given US anti-cartel.

Even if OPEC and Russia can find a way to a deal, it may not be enough. The International Energy Agency, an organization of OECD members established to maintain energy security, weighed in that 10 MMbpd cuts may be insufficient to balance markets. The agency added that unprecedented demand loss would leave 15 MMbpd flowing into global storage even after 10 MMbpd cuts. For more on why fuel buyers may actually support higher prices, check out our FN article from last week.

In the US, weeks ago the Department of Energy did an about-face after announcing Strategic Petroleum Reserve (SPR) purchases. Instead of buying crude, the agency is now renting 77 million barrels of SPR storage to oil companies. With crude runs so high, producers are scrambling to find storage availability. Without it, oil wells and pipelines may be forced to shut down because there’s physically no way to manage the resulting product.

The DOE’s storage rental plan will have a similar effect to SPR purchases in the short-term – it provides a place for producers to send their crude, so they don’t have to shut down operations. In the long-term, though, all that privately-owned crude will have to hit the market eventually, which could result in a lower-for-longer price environment. SPR purchases sit in reserve until an emergency occurs, and as such would not have contributed to supply imbalances. According to White House officials, funding for SPR purchases was not approved by Congress, which is why the administration proceeded with its next-best option. Overall, though, 77 million barrels of storage, which can only be filled at a rate of 685 kbpd, is a drop in the bucket compared to the massive global supply imbalance.

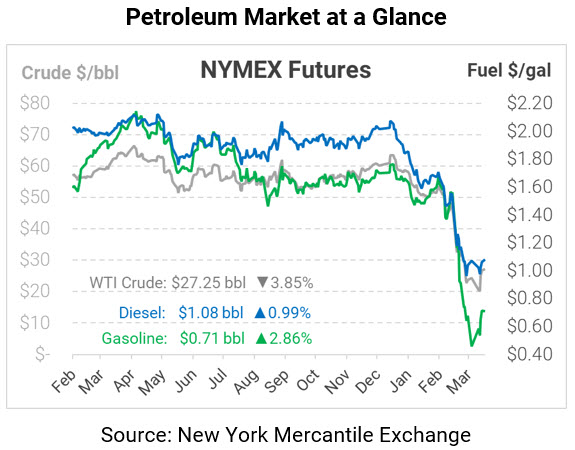

Crude oil this morning is trading a bit lower on concerns over OPEC+ negotiations. WTI crude is trading at $27.25, down $1.09 (-3.9%) from Friday’s closing price.

Unlike crude, fuel prices are up slightly this morning. Diesel prices are trading at $1.0812, up 1.1 cents (1%) from Friday’s close. Gasoline prices are trading at $0.7114, up 2 cents (2.9%).

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.