Crude Sets One-Day Price Rise Record

Yesterday’s 24.7% gain for WTI crude was the largest single-day percentage gain in product’s trading history, surpassing the record set on March 19 this year. Before that, one would need to look back to 2008 for the next largest gain of just 18% in a single trading day. What has the market in such a tizzy?

President Trump yesterday announced he had brokered a deal between Saudi Arabia and Russia to cut output by 10 million barrels per year. Following the announcement, OPEC+ called a meeting for April 6 to discuss options, and a 10 MMbpd cut remains on the table. However, Trump has yet to offer any cuts from American producers, and Saudi and Russian officials seem unlikely to continue ceding market share to US producers.

Russia’s main grief is with American shale offsetting the effect of production cuts – meaning the US may not need to significantly cut output, but merely cap it to prevent future growth. It will be a hard choice for President Trump, who has long touted America’s energy dominance, to agree to capping output, but it may be necessary for balancing global markets and saving US Shale.

Consumer View: How Should Consumers React to Production Cuts?

In the midst of a global recession, many consumers may view America collaborating with OPEC for higher prices as a problem. Yet they may ultimately gain from more balanced oil markets. With prices so low today, many oil producers in the US are going bankrupt. The majors who can weather the storm are severely cutting their exploration and research budgets. Because today’s exploration dictates production 2-3 years from now – after demand has normalized – an underinvestment could result in a supply shortage in a few years. Paying slightly higher oil prices now enables oil companies to maintain their exploration, which could help keep future prices lower.

Today’s Prices

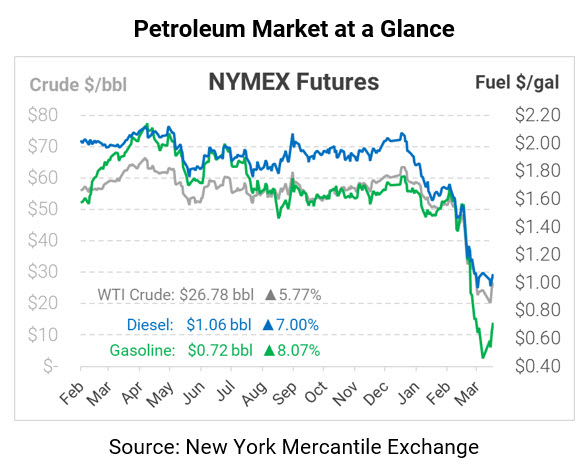

Crude oil is continuing its gains this morning following yesterday’s historic leap. Keep in mind that demand destruction is expected to be a full 10 MMbpd for the next few months, and the OPEC+ cuts would likely come from a higher position than before, leaving a sizable glut of supply until demand picks up again. Given on-going concerns, expect an OPEC+ deal to bring prices back into the $30s or low $40s at most. Today, crude oil is trading at $26.78, up $1.46 (5.8%) since yesterday’s close.

Fuel prices are also rising strongly this morning. Diesel prices are trading at $1.0648, up 7 cents (7%) to solidly above $1/gal once again. Gasoline prices, which fell as low as 50 cents at some points, are currently trading at $0.7163, up 5.4 cents (8.1%) from Thursday’s close.

This article is part of Crude

Tagged: Consumer, COVID-19, opec, OPEC+ Deal, Production Cuts, Record High, Trump

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.