Oil Prices Fall as Chinese Factories Slow Activity

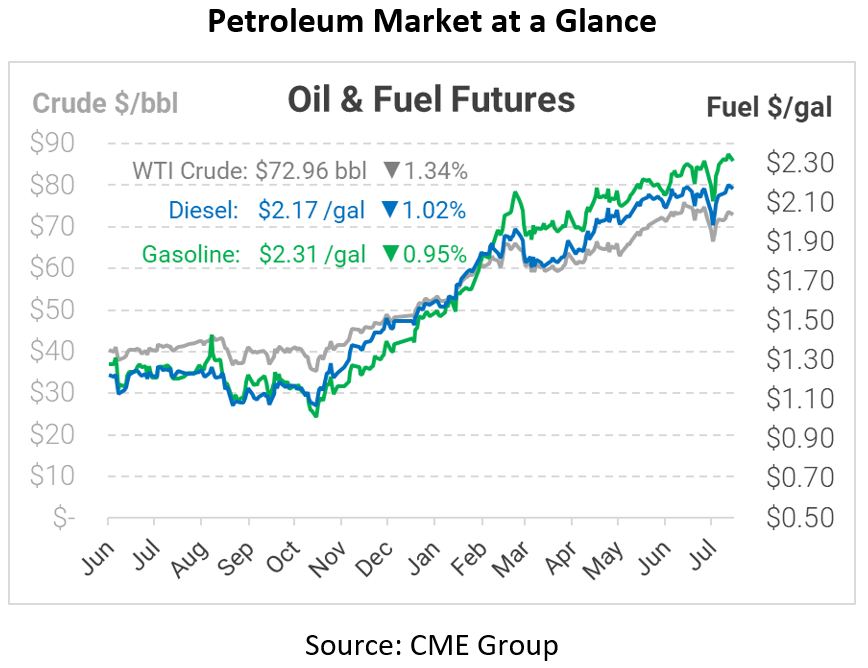

This morning oil prices fell after concerns about Chinese factory activity made headlines. This problem over China and their oil-consumption decrease is accompanied by a sharp increase in Delta Variant cases worldwide. Crude oil opened the day at $73.91, diesel at $2.1910, and gasoline at $2.3303.

Being the world’s second largest oil consumer, China is drawing attention as its factory activity continues to draw the wrong attention. Fears that the economic recovery in Asia is taking steps backward mean that this will undoubtedly affect supply and demand moving forward. Factory activity in China fell heavily in July to numbers not seen in about a year, with reports showing that most of the factories pulling back on activity levels are export-type factories and small manufacturing plants. Investors will be keeping a close eye on Chinese manufacturing as supply and demand are still trying to rebound from the virus.

Due to the highly contagious nature of new virus variants, many have considered the possibility of a mandatory vaccine along with new and updated mask mandates. Last week Atlanta reinstated an executive order stating that masks or face coverings must be worn while indoors at all public places within the city. This is just one example of many new mandates being set around the country to prevent the spread of the virus. According to the U.S. Centers for Disease Control, this has become a full-on “war” against the virus, and people are working around the clock to find ways to stop it from shutting down the country once again. With the increase in cases among those already vaccinated, we will likely see more strict mandates arise in the coming weeks, which could shake up the oil market once again.

This article is part of Daily Market News & Insights

Tagged: Asia, China, Manufacturing, oil consumption

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.