Week in Review – 3 Reasons Oil Recovered from Last Week’s Drop

Prices continued recovering this week after crashing to $66/bbl last week. WTI crude opened at $72/bbl this week and continued climbing from there. Several supportive headlines for oil prices have kept prices from testing last week’s low.

- Federal Reserve Sees Positive Outlook. The Federal Reserve kept interest rates near zero on Wednesday, noting that the economy is strengthening despite pandemic threats. Chairman Powell also noted that the Fed won’t lift rates anytime in the near future. Low rates allow for higher spending and business investment, driving demand and supporting oil (as well as other financial markets like stocks). The Fed is waiting until inflation rises and unemployment rates settle before adjusting interest rates.

- Iran Rejects US Negotiations. Iran’s supreme leader said that the US has been “stubborn” in nuclear talks, one week ahead of the new hardline president being sworn in. A US State Department statement accused Iran of deflecting negotiations. At issue, the US has reportedly sought to add additional conditions before agreeing to a deal. Iran also wants to ensure that the US will not withdraw from the deal in the future. As long as the deal is not signed, Iran’s 2 MMbpd of exports will be kept off the market, supporting oil prices.

- Congress Moves Infrastructure Bill Forward. The Senate this week approved moving forward with a $1 trillion infrastructure bill, receiving bipartisan support. The legislation is a slimmed down version of the $3 trillion bill proposed earlier this year, but Senate Democrats could add to the bill using budget reconciliation. The final bill, though, is not written, and will eventually require support from both houses of Congress. Infrastructure spending would drive an increase in construction and shipping, boosting oil demand and economic activity.

Of course, the three bullish headlines this week are subject to change. The economy could flip due to pandemic outbreaks, or inflation could overheat the economy and erode gains. The US and Iran will eventually reach an agreement, which could unleash more supply on the market. The infrastructure bill seems likely, but there’s still lots of political debates, both across party lines and within each party.

While market forces are supporting oil prices this week, there’s still plenty of uncertainty about where oil will trend in the weeks to come.

This Week in Energy Prices

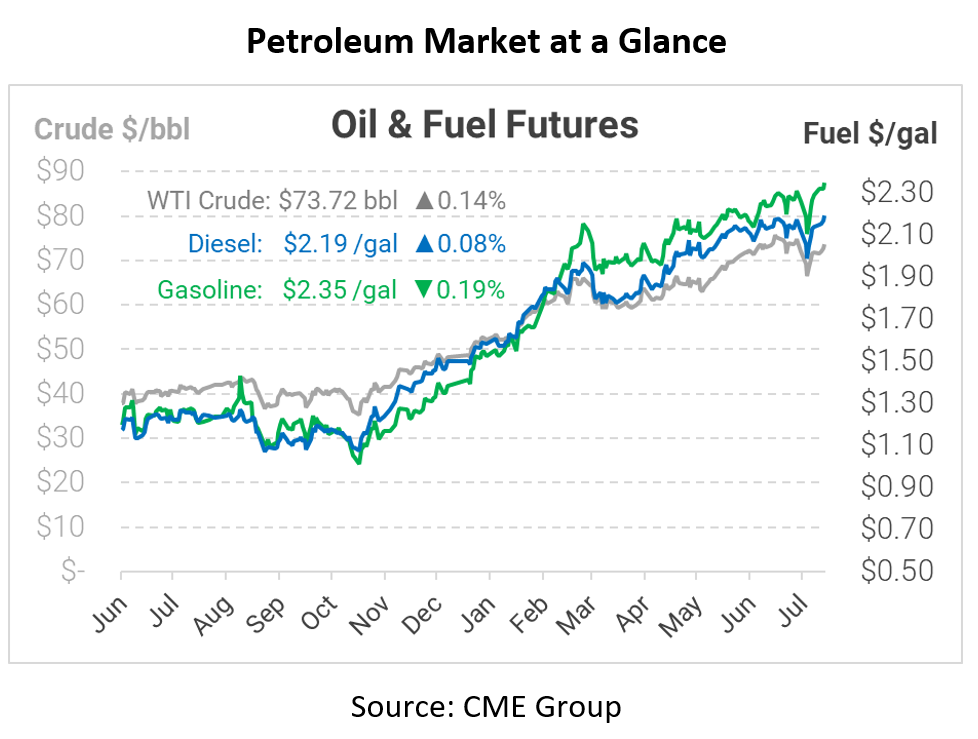

Crude oil opened Monday at $72.18, hitting some bearish sentiment early in the week. After Tuesday, though, oil prices began climbing higher, supported by significant crude inventory draws. The latter half of the week saw continued movement higher. WTI crude opened at $73.41 this morning, a gain of $1.23 (+1.7%)

Diesel prices also rose throughout the week, opening at $2.1358. Although prices experienced a brief downturn on Monday, they closed the day higher, then continued climbing for the remainder of the week. Diesel opened this morning at $2.1826, up 4.7 cents (+2.2%).

Like other products, gasoline products recovered from last week’s dip and posted gains. Gasoline opened the week at $2.2952, already up almost 20 cents from the previous week’s price. Prices continued rising through the week, hitting $2.3440 at this morning’s opening, a gain of 4.9 cents (2.1%).

This article is part of Daily Market News & Insights

Tagged: Congress, crude prices, Federal Reserve, Infrastructure, iran deal

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.