Nothing Sure but Death and Taxes – Except Maybe Not?

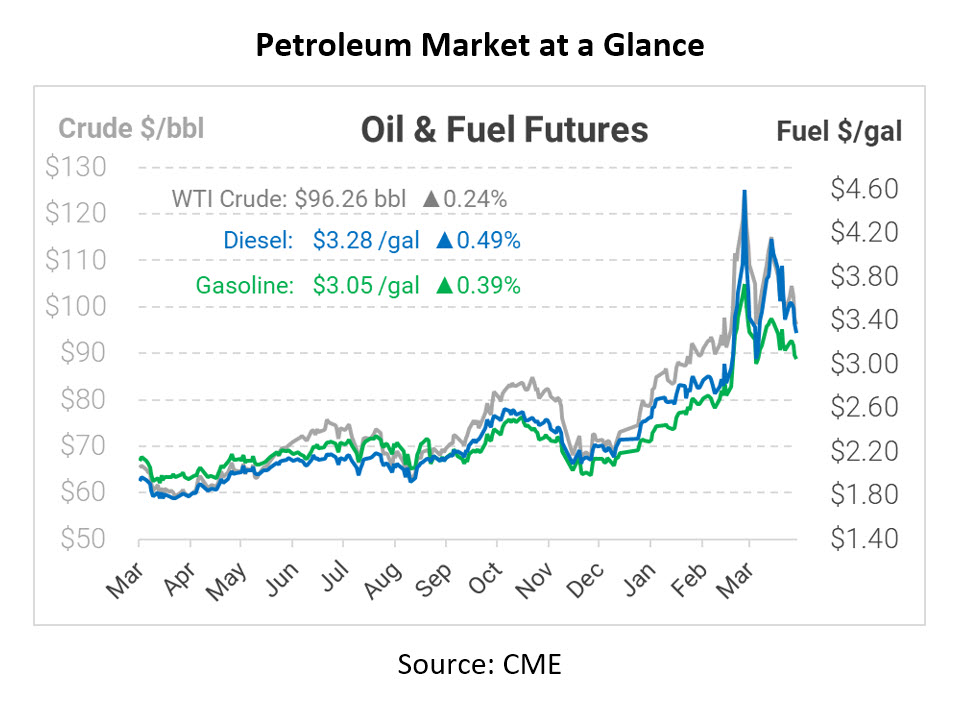

It’s been said that nothing in life is certain but death and taxes – but in the case of fuel, even taxes may not be a given. Throughout North America, legislatures have been evaluating whether to give consumers a break from fuel taxes to bring some relief at the pump. Although prices remain as volatile as ever, measures have passed in four places – Georgia, Maryland, Connecticut, and Alberta – with more potentially on the way.

Maryland and Georgia were the first to implement the motor fuel tax suspension. On average, consumers in those states are now enjoying a 30-37 cents per gallon discount depending on the fuel product, a welcome relief from rising prices. States can only waive certain taxes, so consumers are stilling paying some local and federal taxes on fuel. Those first two state waivers went into effect midday on March 18, so the first first full day those laws were effective was March 19. Connecticut and Alberta each jumped on board a few days later, issuing waivers from April 1 through May 31.

Other areas are also considering relief. In Virginia, the governor has proposed waiving the state’s 26.2-cent gasoline tax and 27-cent diesel tax. Florida recently announced a gasoline tax holiday in October to come after peak tourist season. California is considering a $400 rebate to taxpayers to offset the higher cost of fuel. Other states have also debated the measure, with less concrete outcomes. At the federal level, bills have been introduced in Congress to temporarily remove the 18.4-cent federal gasoline tax and 24.4-cent diesel tax.

For truck drivers, the waivers are a welcome relief, but also introduce some new complexity. Per IFTA requirements, truckers will need to track mileage and pay fuel taxes out of pocket if they buy in a tax-exempt state and drive through a neighboring state. Conversely, drivers filling up in a nearby state then driving through a tax-exempt state would qualify for a tax exemption. Although few people relish tax reporting and tax changes, at least these updates could leave more dollars in your account for the next several weeks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.