Crude Hits 7-Week Low – What’s Driving Prices Down?

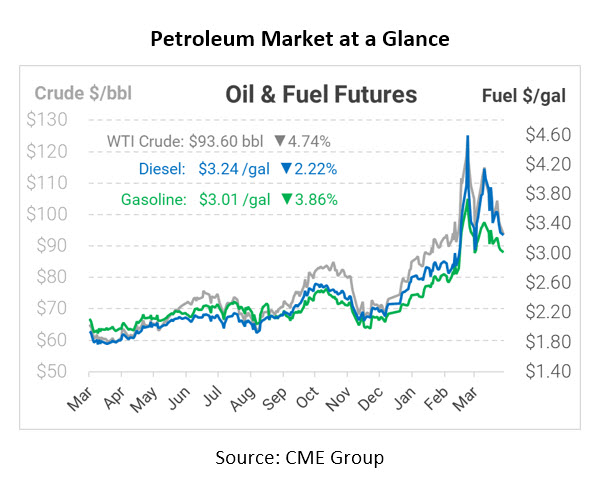

Americans are waking up to a welcome sight this morning as WTI crude oil hits a 7-week low, retreating as far as $92.93 in the early hours of the morning. It seems that it was just the other day when oil reached $140/bbl, and slight panic set in for many. But as we have written before, time has repeatedly proven that high prices will not last forever. So now that oil is starting to show signs of relief, what are the main factors driving prices down?

A big piece of the recent price drop stems from COVID-19 concerns. While the West has largely moved past the virus, Asia is facing rising cases. China is one of these countries, still having shut down major cities such as Shanghai. With China being the world’s second-largest oil consumer, that means more supply is available. Chinese citizens are currently unable to do most of their daily activities such as driving to work, driving to the store, and taking vacations; Chinese industries are also hobbled. Pair this with China’s consumer prices rising around 1.5% last month, and you have a weak growth outlook for one of the biggest economies in the world.

Nobody is cheering that China is consuming less oil because of their COVID-19 struggles. Still, their situation has undoubtedly helped drive these high prices down. The second factor to be watching for in the coming weeks is the effects of the strategic petroleum release by IEA members. An astounding and historical 240-million-barrel release is planned in the coming months that will surely drive prices down even further. With OPEC+ refusing to increase their production and many American oil companies reluctant to increase production due to the financial hardships associated with the pandemic, governments are forced to tap into emergency reserve to provide reliable supply. We are at a point where it’s taking substantial change – from major economic slowdowns to coordinated international oil releases – to significantly move the market back to pre-Russia invasion levels.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.