Mid-Week Review – December 11, 2019

The U.S. Dominates New Oil and Gas Production

Since fracking took off in 2008, we have more than doubled our proven oil reserves to ~65 billion barrels. Natural gas reserves have surged over 80% to ~430 trillion cubic feet. Already the largest oil and gas producer, the U.S. is set to increase its share of ~17% of global oil production and ~23% of gas. In the 2020s, the U.S. is set to supply over 60% of new oil and gas. Click here to read more from Forbes.

China Quietly Ramps Up Oil Production in Iran

Located around 80 kilometers west of Ahvaz, close to the Iraqi border, the entire 900 square kilometer Azadegan field is the third-largest hydrocarbon reserve in the world after the Ghawar oil field in Saudi Arabia and the Burgan oil field in Kuwait. Its total reserves are estimated at about 42 billion barrels of oil, with around 7 billion barrels currently deemed recoverable. Click here to read more from Oilprice.com.

Aramco IPO to help Saudi economic shift from oil, says finance minister

Saudi Aramco’s listing will boost the kingdom’s efforts to diversify from oil as the bulk of proceeds will be injected in domestic projects, while the global buzz surrounding the deal will help lure foreign capital, the finance minister said. Aramco’s shares surged the maximum permitted 10 percent on their Riyadh stock market debut on Wednesday, following the state-controlled oil giant’s record $25.6 billion initial public offering (IPO). Click here to read more from NBC News.

Saudi Arabia Isn’t Getting Bullish About Oil for 2020 Budget

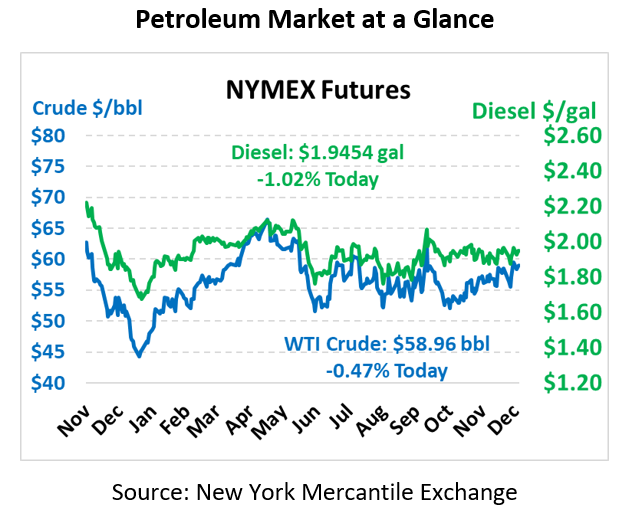

A year after a rare bullish call on oil, Saudi Arabia isn’t counting on much of an uplift from crude prices in 2020. The world’s biggest oil exporter has designed next year’s budget under the assumption that Brent will average about $65 per barrel, according to calculations by Ziad Daoud, Bloomberg’s chief economist in the Middle East. EFG Hermes puts the budget’s assumed oil price at $60 to $62, while Capital Economics has it between $55 and $60. Click here to read more from Bloomberg.

This article is part of Crude

Tagged: crude, Daily Market News & Insights, diesel, gas

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.