Fed Leaves Rates Unchanged

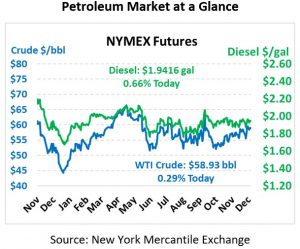

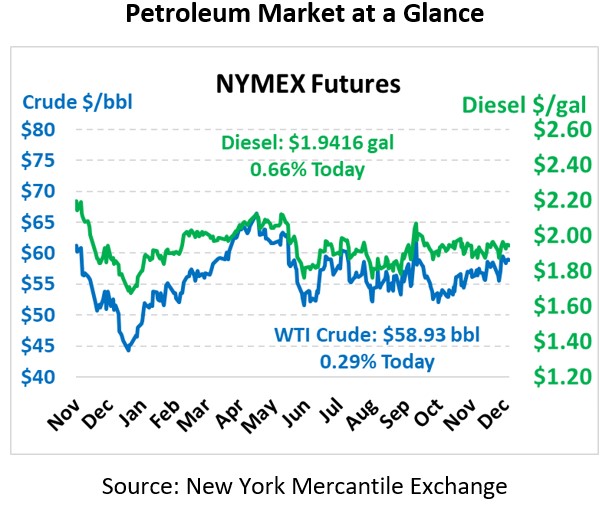

Oil prices are up this morning, recovering some of yesterday’s losses. WTI Crude is trading at $58.93, a gain of 17 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.9416, a gain of 1.3 cents. Gasoline is trading at $1.6323, a gain of 0.6 cents.

On Wednesday, crude prices fell 48 cents to close at $58.76. Yesterday, the Federal Reserve painted a more positive macro-economic outlook as they left interest rates unchanged. This positive outlook helped to lift markets until bearish inventory news brought markets lower. The weekly EIA report showed total combined stocks of crude oil and refined products rise by 10.3 MMbbls.

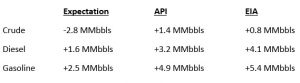

The EIA reported a surprise build for crude of 0.8 MMbbls, verses an expected draw of 2.8 MMbbls. At Cushing, the EIA reported a 3.4 MMbbl draw. The EIA reported distillates had a larger-than-expected build and gasoline also saw a larger-than-expected build.

In other news, the IEA said in its Oil Market Report that global oil inventories could rise sharply despite an agreement by OPEC+ to deepen cuts and expectations for lower production from the US and other non-OPEC countries. The report also showed global oil demand increased by 900 kbpd year over year in Q3 of 2019, the strongest annual growth in a year with nearly three-quarters of the growth occurring in China. For 2019 and 2020 the IEA has left unchanged their global oil demand growth forecasts at 1 mmbpd and 1.2 mmbpd, respectively.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.