Lower Prices, Stronger Dollar as Traders Flock to Safety

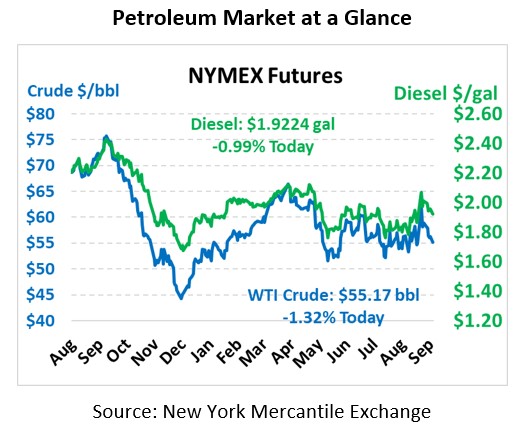

Oil prices are trading lower this morning. Markets continue shrinking back, extending last week’s losses amid continued diplomacy in the Middle East. Crude oil this morning is trading at $55.17, down 74 cents.

Fuel prices are down this morning. Diesel is trading at $1.9224, down 1.9 cents. Gasoline is also trading lower at $1.6338, a loss of 1.8 cents.

Saudi Crown Prince Mohammed Bin Salman commented this weekend that oil prices could reach “unimaginably high numbers” if Iranian aggression is not curbed immediately, which would seem to be bullish. However, markets are interpreting the comment as placing a high premium on peace, which could push the countries towards diplomacy. Some security experts have noted that Saudi Arabia’s conventional-style military would be poorly matched against Iranian forces who deploy less conventional weaponry such as drones and cyberattacks, providing further incentive for Saudi Arabia to pursue a peaceful resolution.

Adding to downward price pressure is a strengthening US dollar, which is inversely correlated with commodity prices. With interest rates globally at low levels, investors are flocking to the US dollar and safer US investments such as treasury notes and bonds. Investors are showing caution, backing out of volatile equity and commodity markets and heading for safety. Of course, the political climate in the US is anything but “safe” right now amid a US-China trade war, impeachment hearings and an election campaign cycle, so investors will have to take the best they can get.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.