Markets Rise on Lower Output and Equity Gains

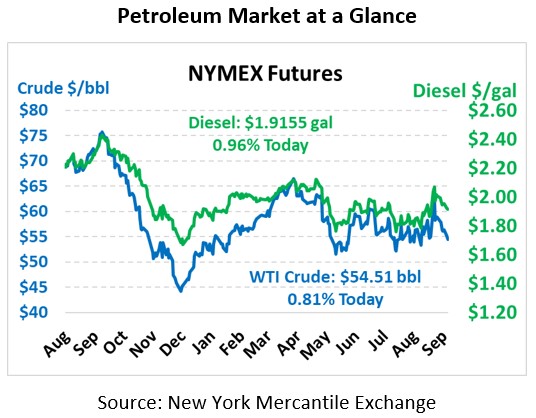

Oil prices are getting a lift this morning, a break from the five-day down streak the market has experienced since last week. Crude oil is currently trading at $54.51, up 44 cents.

Fuel prices are also moving a bit higher, though the switch to November futures contracts has gasoline trading a bit lower than October future prices. Diesel prices are trading at $1.9155, up 1.8 cents from yesterday’s close. Gasoline prices are $1.5905, up 2.4 cents.

Official data points to lower output from the world’s top three suppliers in recent months. The EIA reported that America’s July production was down 276 kbpd, a break from the strong supply growth experienced over the past few years. Russia saw production fall by 50 kbpd in September. Unsurprisingly Saudi Arabia wasn’t quite up to par either given their massive outage in mid-September, leading overall OPEC output to its lowest level since 2011. With Saudi Arabia’s output largely back online, though, expect the numbers to tick higher in October.

While oil markets are trading lower, the overall financial market seems to be in good spirit. The first 9 months of the year have been the best YTD results since 1997, up 19% this year according to the Wall Street Journal. Amid talks of economic gloom on the horizon, it appears Wall Street missed the memo. Resuming trade talks between the US and China in a couple weeks may (or may not) help continue that strong market performance.

This article is part of Crude

Tagged: China, eia, financial market, oil prices, production, Russia, Saudi Arabia, Supply, US, Wall Street

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.