Fuel Export Ban? Why Keeping Gasoline at Home Would Raise Prices

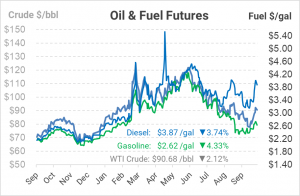

Oil prices remain stubbornly high this morning, with the OPEC+ cuts last week lifting crude oil above $90/bbl and diesel above $4/gal. With oil markets tightening once again, the Biden administration is searching for any remaining tools to lower prices. Few options remain, but one has become a popular topic over the past week – a ban on fuel exports. The assumption is that rather than exporting fuel, that product could go to domestic inventories, which would in turn lead to lower prices. The export ban has been widely opposed by industry sources, who argue that a ban would have the exact opposite effect on markets.

The biggest challenge with an export ban is that only some would benefit. An export ban would likely be met with reciprocal moves from other countries. Areas with heavy fuel production, such as the Gulf Coast, would see lower prices due to the measure. However, reduced imports would hurt markets such as the Northeast, since American oil infrastructure is not equipped to move fuel around efficiently to those markets. The API and APFM have also argued that banning exports would force Gulf Coast refiners to reduce throughput, which would lower overall fuel levels globally.

Second, the problem with domestic storage is not a lack of production, but rather the market’s backwardation that makes inventories too expensive to hold. Backwardation tells suppliers to pull from inventory for immediate consumption. An export would steepen the backwardation by harming East Coast supplies, making storage fall even faster. Thus, the proposed export ban would do the opposite of the White House’s intentions.

This article is part of Daily Market News & Insights

Tagged: API, Backwardation, Export Ban, White House

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.