Week in Review – October 7, 2022

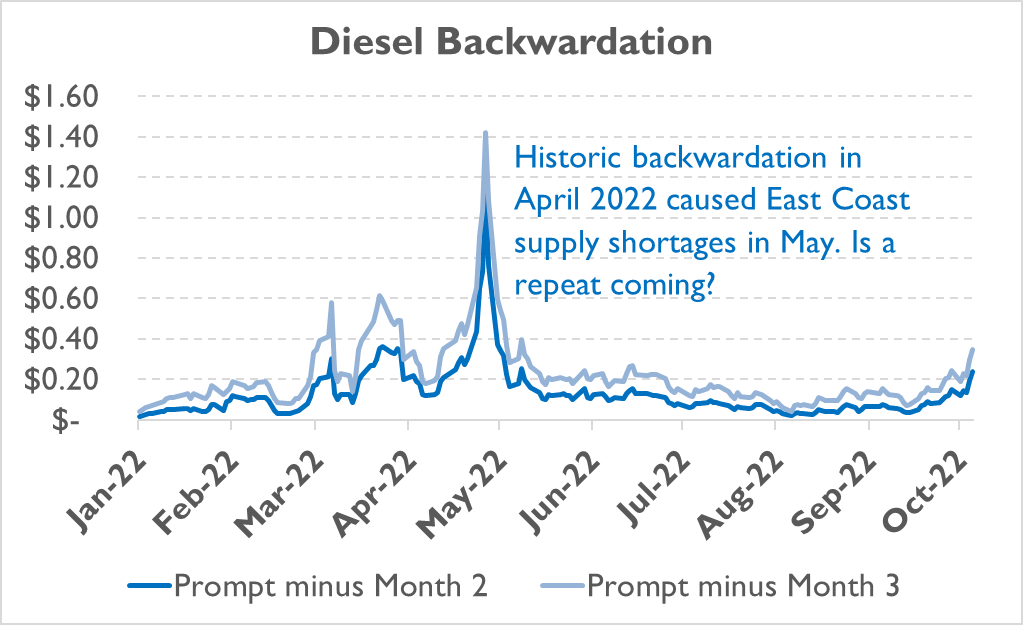

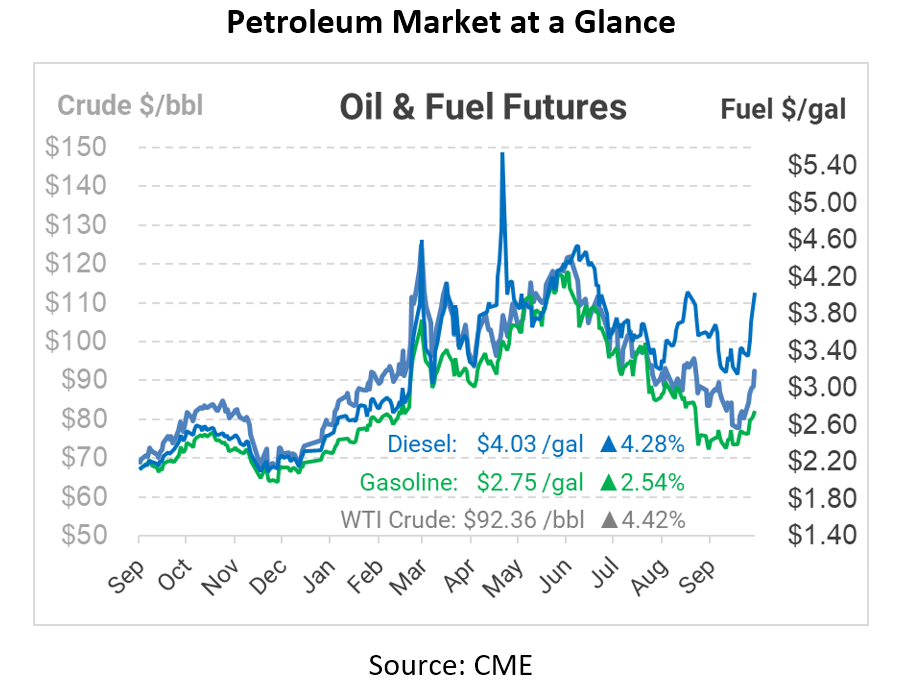

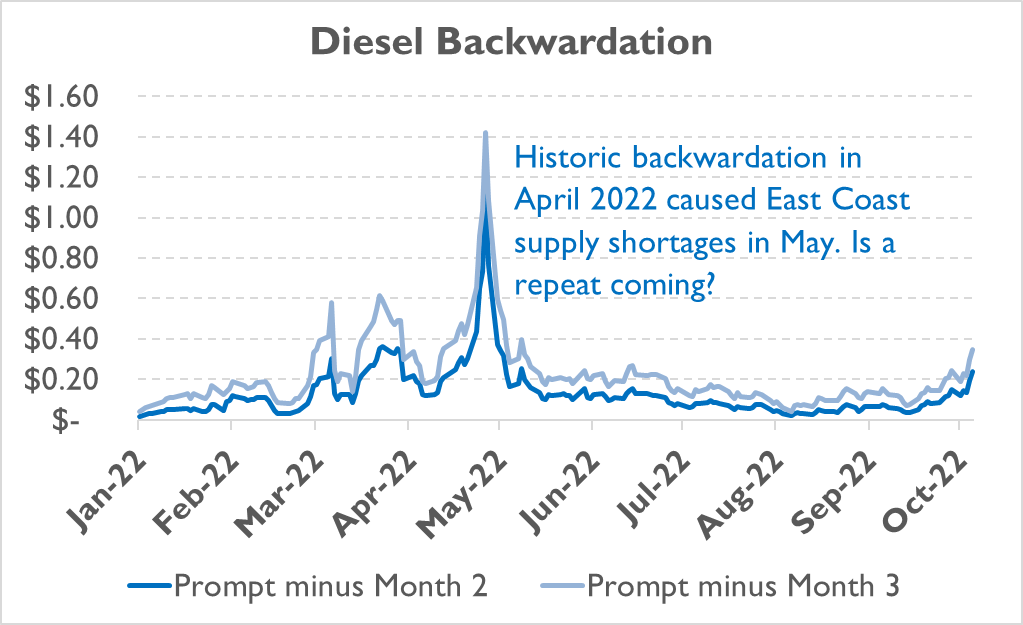

OPEC is back in the driver’s seat when it comes to oil prices. Their decision this week to cut supplies by 2 million barrels per day sent prices leaping higher. Crude oil is up nearly $10/bbl this week, and diesel prices are up a full 60 cents per gallon. Market backwardation is beginning to creep higher – meaning markets see immediate supply challenges that will keep markets tight. [Check out this recap on backwardation.] The last time prices began moving this high, backwardation shot above $1/gal, causing major shortages along the East Coast due to pipeline shipping times.

As we reviewed yesterday, the OPEC decision will weigh heavily on markets. Several major banks have increased their market forecasts above $100 in the coming quarters, including Goldman Sachs, UBS, JP Morgan, ANZ. For consumers, it seems highly likely that higher prices are ahead. Although the group was not producing at 100% of their quotas, the way cuts were distributed makes the actual impact roughly 1.2 MMbpd – a significant reduction.

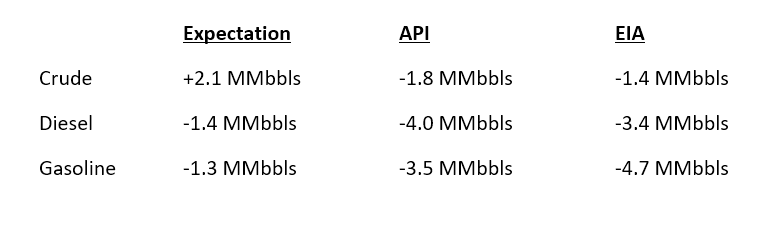

In US news, the EIA reported across-the-board draws from crude oil and fuel inventories this week, adding to bullish pressure. Crude stocks fell 1.4 million barrels last week, compared to an expected build. One reason could be Hurricane Ian, which took offshore production offline temporarily. Diesel and gasoline inventories each fell also, as refinery maintenance took production offline.

Prices in Review

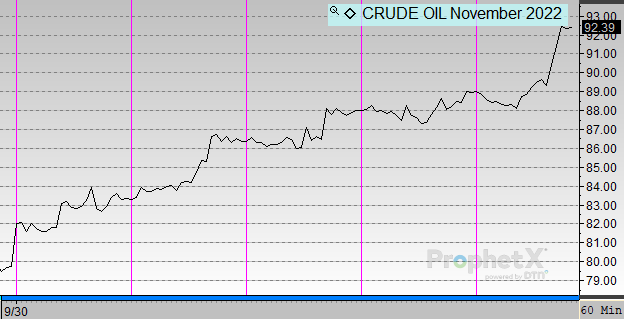

Oil prices rose steadily this week, starting with anticipatory trading regarding OPEC’s decision followed by more substantiated increases later on. WTI Crude opened the week at $81.02, up from the prior week’s dip into the $70/bbl range. Prices rose each day, resulting in an opening price this morning of $88.93 – a gain of $7.91 (+9.7%). Later gains have pushed oil above $90/bbl.

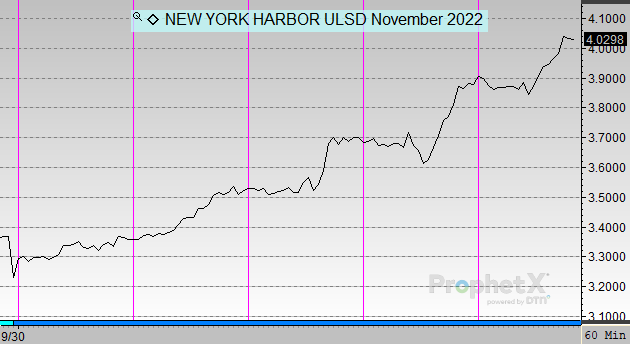

Diesel prices have exploded as supply concerns mount. This week, the market seems to have awoken to realize that inventories have not grown ahead of the winter demand season. Diesel began the week at $3.2650, after experiencing several bearish weeks. With OPEC’s decision and continued diesel inventory draws, though, prices climbed quickly thorough the week. This morning, diesel opened at $3.8787, up 61 cents (+18.8%) for the week – with further gains pushing the product above $4/gal.

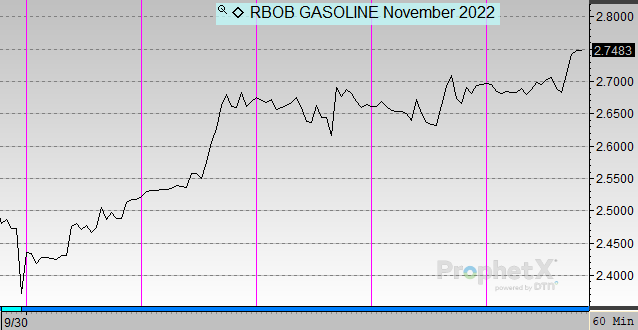

Gasoline’s gains fell between crude’s moderate uptick and diesel’s large rally. Beginning the week at a modest $2.3887, gasoline soared above $2.50 quickly, continuing to climb higher along with the broader market. This morning, gasoline opened at $2.7001, up 31 cents (+13.0%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.