OPEC+ Cuts Supply – 3 Reasons Why, and What It Means for You

Yesterday, OPEC+ agreed to a production cut of two million barrels per day (MMbpd) – larger than the expected 1 MMbpd cut. Particularly surprising was how the cuts were made. Rather than applying more of the cuts to countries that are already underproducing (such as Nigeria, Russia, and Kazakhstan), the cuts were proportionally divided among members. That means that members who had been producing at their quota limit will have to restrict output, giving the cuts a more substantial impact. Although the full effect will be diluted by underproduction, Goldman Sachs estimates that the net effect of the decision will be 1.2 MMbpd in material cuts.

During yesterday’s meeting, the OPEC+ group extended their alliance through the end of 2023, with plans to evaluate markets bi-monthly and meet every six months. Saudi Arabia noted that the new reduced quotas will extend through the end of next year, which Goldman Sachs estimates will lift 2023 price forecasts by $25/bbl.

You might ask – what is OPEC+ thinking? Prices are already so high; why move them higher? There are three reasons why OPEC+ is taking this action:

- Their stated reason for the cuts is falling demand due to a recession. OPEC+ data shows that supplies are relatively balanced currently, but demand is slowing down. To get ahead of weaker prices and prevent prices from collapsing to $65 or below, they are cutting early.

- It’s no secret that OPEC+ likes higher prices. Anonymous officials have hinted that the group is more comfortable with oil around $100 – they believe that price is the maximum level that won’t cause demand destruction. Based on that, they may be trying to push prices higher to bolster their pocketbooks.

- Geopolitics may also be at play. Russia is the second largest producer in the OPEC+ group, giving them significant influence. Although Saudi Arabia and the US have historically been allies, Saudi Arabia needs Russia on board to keep the group together. For that reason, their stance on oil production has aligned more closely with Russia’s interests lately than with the US.

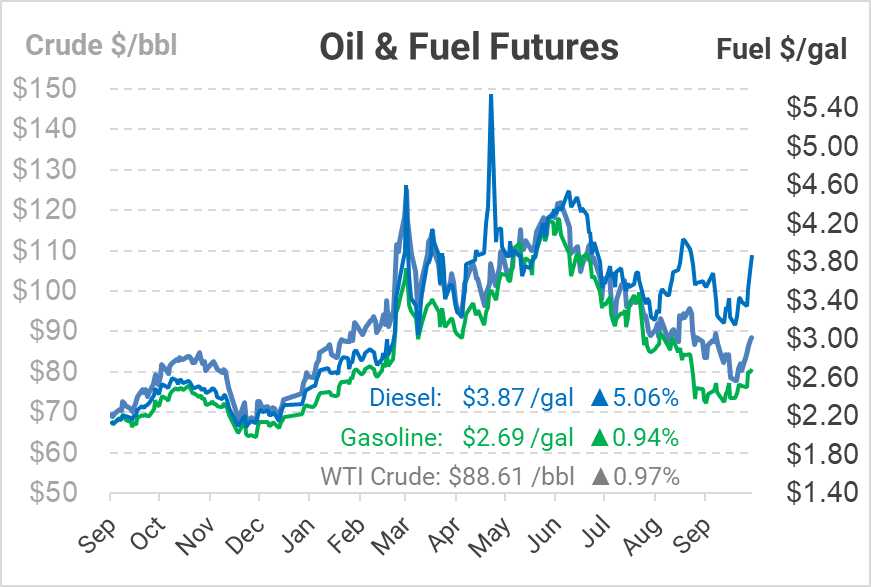

For customers, falling US inventories mixed with OPEC supply cuts paint a stark picture of future prices. With embargos on Russian oil set for January and less OPEC+ supply available, markets are almost certain to be short on oil. The question becomes whether a recession causes demand to fall. If so, supply and demand will both be down, creating a rough balance. If not, then supply will be lower while demand remains steady, meaning higher prices. Either way, it’s not a happy outlook for corporate buyers.

This article is part of Daily Market News & Insights

Tagged: opec, Price Forecast, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.