Fed Approves Interest Rate Hike – First in Over Three Years

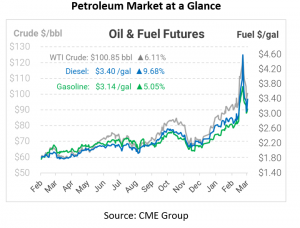

This morning oil prices are rising again, jumping up around 6% from yesterday after three straight days of losses. The International Energy Agency (IEA) warned of “the biggest supply crisis in decades” as Russian exports are set to drop by 3 million barrels per day next month. It’s a sign of recent volatility that diesel prices are up 30 cents this morning, and it’s not even the largest story of the day. Instead, traders are looking closely at the Federal Reserve.

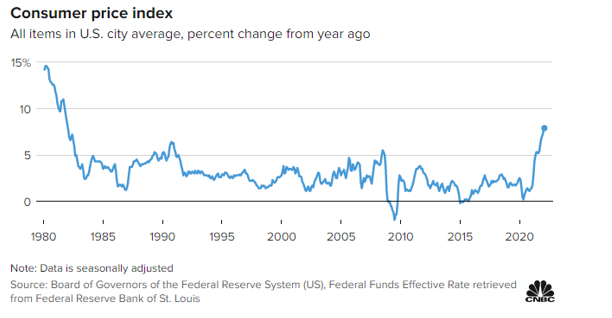

Yesterday, the Federal Reserve agreed to the first interest rate increase in more than three years. With inflation skyrocketing to record levels, the Fed hopes to curb rising prices through interest rates. The Federal Open Market Committee released news on Wednesday that they would be raising rates by 0.25%, or 25 basis points. The Fed will not stop with this increase, however, noting plans to hike rates six more times this year until rates hit 1.9%.

Markets have grown accustomed to historically low interest rates, with the Federal Funds rate hovering near zero since the Great Recession. The Fed had begun a rate hike in 2019 (peaking at 2.4%), only to have COVID-19 send markets spiraling. Increasing interest rates reduces borrowing, which means less business and consumer spending. Less spending isn’t exactly “good”, but it should help with price inflation, since lower demand can help slow rising prices. Markets usually drop after the Fed announces higher interest rates, but with consumer prices spiking dramatically to 7.9% and gas prices rising 38% in just 12 months, markets are treating the news like a real pot of gold.

Shifting to the ongoing Ukrainian conflict, President Joe Biden yesterday called Putin a “war criminal” in an off-the-cuff comment as the senseless killings of Ukrainian civilians continue. The comment is the first such declaration from a US official, though the administration later clarified that legal action is still pending regarding Russia’s criminal activity. After an emotional address to the world by Ukrainian President Volodymyr Zelensky, Biden took to the mics and cameras to show that the United States stands behind Ukrainians. Biden said he would be sending in military assistance in the form of anti-aircraft, anti-armor, weapons, and drones. With more aid going to Ukraine, and Russian forces struggling to make progress, it appears the conflict could be far from over – meaning more volatility and uncertainty in the weeks ahead.

This article is part of Daily Market News & Insights

Tagged: Biden, Fed, Federal Reserve, interest rates, Ukraine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.