East Coast Diesel Shortage – 4 Indicators to Watch

Earlier this year, supplies along the East Coast became extremely tight, forcing fuel suppliers to go to high alert and wreaking havoc on supply chains. The problem wasn’t a hurricane or a pipeline outage… there simply wasn’t enough supply in the pipeline to cover demand across the East Coast. On one hand, tight supplies in Europe limited fuel imports and caused exports to climb. In addition, market economics moved radically, making pipeline deliveries unprofitable and causing supply to dry up. Similar factors are beginning to show in the marketplace again – is an East Coast supply crunch coming this winter? Here are 4 indicators to watch carefully.

1. Market Backwardation

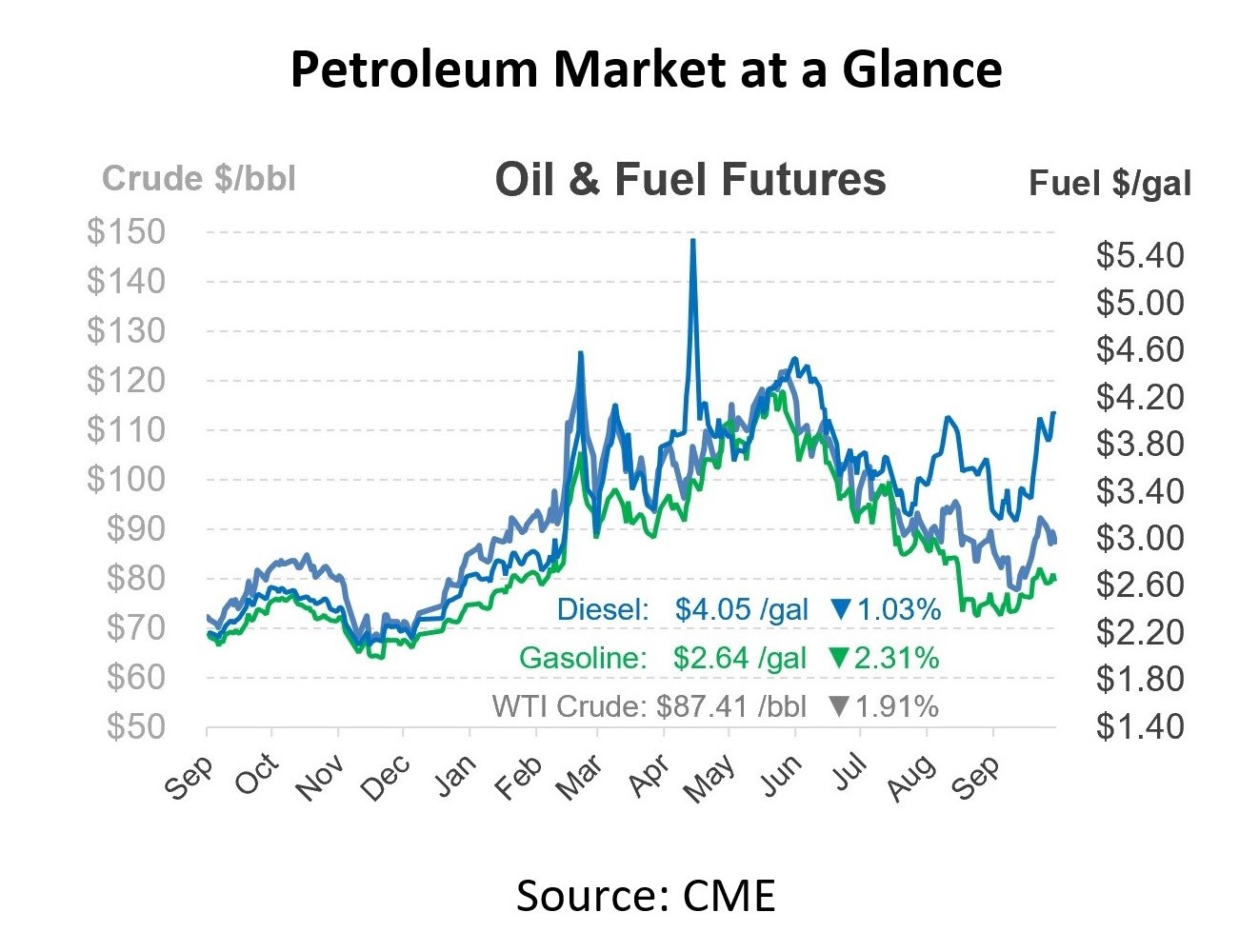

As we covered earlier this week, the diesel futures market is steeply backwardated, meaning that prices in the short-term are much higher than prices just a few months from now. A similar dynamic occurred in March and April, culminating in soaring diesel prices in May that caused major supply shortages. Although backwardation is nowhere near as bad as it was in May 2022, it is at the highest level its been since that time – and continuing to rise.

Steep backwardation makes it risky to ship fuel via pipelines since fuel takes days or weeks to reach its destination on a pipeline. If you buy the fuel at $4 today but sell it at $3.50 because of market backwardation, you’d lose $.50 per gallon – a frightening risk for fuel shippers. Therefore, shippers pulled out of the market in May, causing shortages throughout the East Coast. Backwardation doesn’t need to hit $1/gal before it becomes risky for shippers… even 20-cent losses can be detrimental, so keep a close eye on this indicator.

2. Diesel Inventories

Diesel inventories have fallen for the past three weeks, sending supply levels to historic seasonal lows. Demand has been patchy lately – a response to volatile, high prices – which has prevented low inventories from being detrimental, but it’s certainly been challenging. Low inventories aren’t a challenge by themselves – in general, as long as refiners keep producing at high levels, there should be enough fuel to go around. But if there’s any disruption in supply – such as a refinery outage, winter storm, or the labor strikes currently in France – it can quickly spiral from a hiccup to a crisis.

3. Winter Temperatures

Winter weather will be particularly important this year, since many consumers in the northern US use natural gas and heating oil to warm their homes during cold weather. Across six major winter forecasts, most outlooks show warmer weather in the south, but colder temperatures in northern states. Chilly weather in the north could prompt higher demand for heating oil and kerosene, exacerbating already short inventories. The EIA’s recent Winter Fuels Outlook suggests this winter will be 6% colder than the 10-yr record, as measured by the number of days and total degrees below mild 60 degree weather.

4. Imports & Exports

Over the last week, the US exported more fuel than it’s ever exported before – over 5 million barrels per day. As Europe tries to reduce its reliance on Russia, they’ll need to pull more fuel from the US. At the same time, other countries such as South America are also reliant on US fuels. More fuels finding their way abroad means less left in the US – meaning US consumers will have to pay more to keep American fuel at home.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.