Chinese Economy Boosts Oil Market Confidence

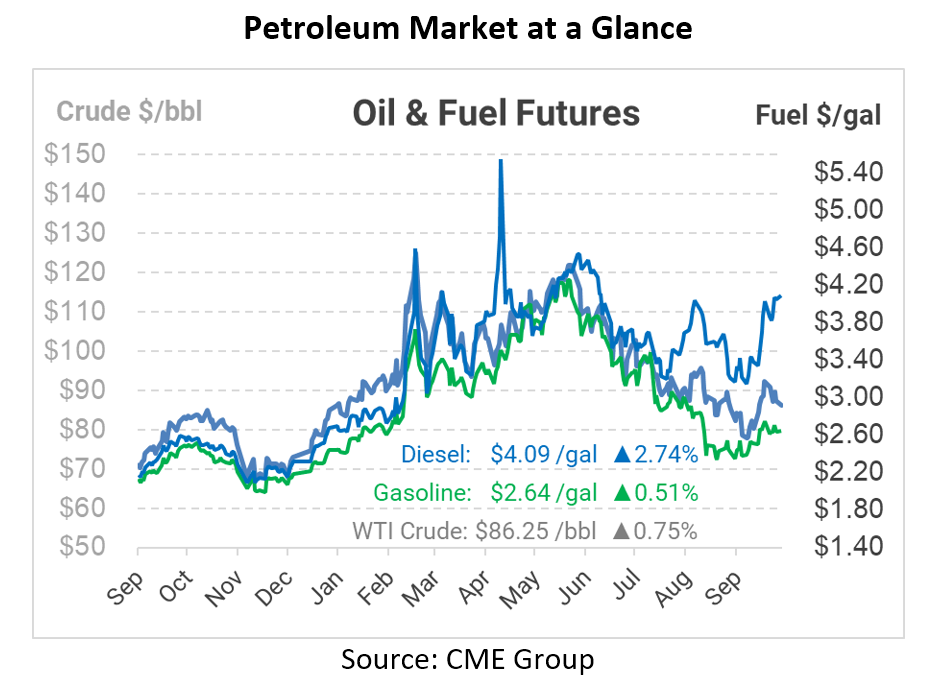

Oil markets continue to face volatility, with fuel prices rising even as crude oil sinks a bit lower. Fuel markets are continually facing pressure from falling inventories, with diesel supplies at their lowest seasonal level in 40 years. In addition to domestic pressures, international news is also pushing prices higher. China is making moves this week that convey confidence in their economic future, helping to support prices today.

China held their interest rates steady this week, counter to measures taken in many other leading economies to raise interest rates and curb runaway inflation. China is functionally saying they don’t see the same challenges as the rest of the world, instead keeping money cheap to ensure continued growth. On the energy front, China is expanding their oil coffers to make room for additional reserves and bolstering risk management policies over energy supplies including oil, natural gas, electricity, and coal. The news is bullish for oil prices – as the world’s largest oil importer, Chinese consumption dominates demand forecasts. Their continued appetite for crude oil will keep steady pressure under the market.

In other international news, the “war of words” continues escalating between the US and Saudi Arabia. The White House has accused Saudi Arabia of coercing OPEC members in order to push the cuts through, though oil ministers from many OPEC members have rejected the allegation. US officials have characterized the decision as Saudi Arabia siding with Russia instead of the US, and President Biden is reportedly looking at countermeasures to punish Saudi Arabia for the decision. We’ll see in the coming weeks what efforts are taken and what, if any, impact they have on OPEC strategy.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.