Diesel Shortage Shows in Crack Spreads

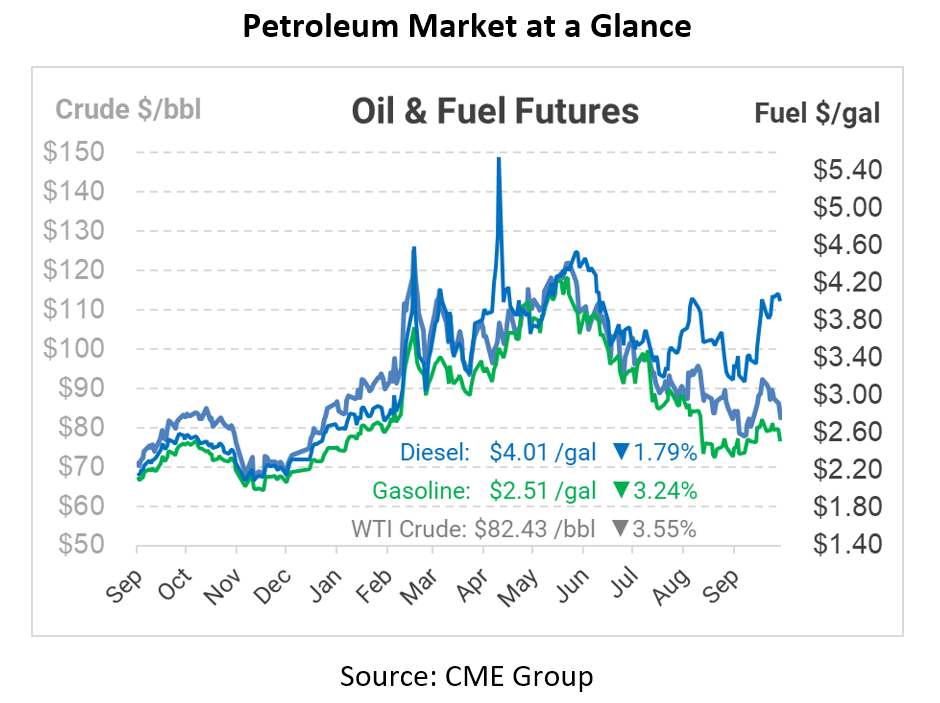

Oil markets continue facing challenges, with crude oil down this morning but diesel prices staying stubbornly high. The spread between the two products has increased to the highest level since March. Normally, a barrel of diesel is only $20-$30 per barrel more than a barrel of crude oil; lately, it’s been 3-4x that range. Crude oil is currently trading back in the low $80s, where it was before the Russia invasion, yet diesel is still above $4/gal.

Platts noted yesterday that high diesel prices are problematic on both sides of the Atlantic Ocean, with the East Coast US fighting against Europe to secure diesel supply. With refiners on both sides of the pond undergoing maintenance and France suffering from labor strikes, refined products are in very short supply. Diesel inventories along the US East Coast are almost half of their seasonal five-year average.

As the weather gets cooler, diesel markets could continue tightening. In both the US and Europe, many places use heating oil (diesel) to keep their homes and businesses warm. Cold weather also means more electricity demand. With natural gas prices at historic highs, electric utilities are expecting to use more oil (diesel or equivalent distillate fuels) to keep the lights on. Whether you look at market headlines, diesel crack spreads, inventories, or backwardation – every part of the market is trumpeting the same message: expect diesel tightness and volatility in the months to come.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.