Natural Gas News – January 21, 2025

Natural Gas News – January 21, 2025

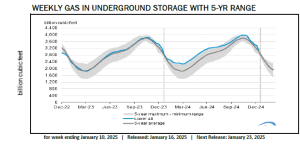

Mansfield Market Assessment

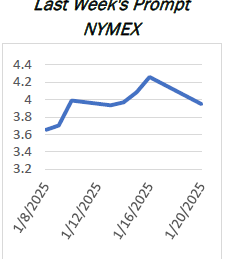

Peak cold from winter storm Enzo has taken full effect and is expected to last for a few more days. The weather models indicate a warmup starting in 11-15 days for most of the continental United States. Currently we are seeing around 5 Bcf of shut-ins primarily in the Permian Basin and Rockies. February Henry Hub Futures are down .13 cents to $3.815 today. Additionally, the Freeport LNG facility has tripped intra-day and has lost around 2 Bcf of LNG. That gas will likely go back into the market to either meet load or head to storage. Look for continued volatility as the market is trying to digest what February’s weather will bring.

Bearish Forecast as Futures Slide Despite Arctic Blast

Natural gas futures extended their losses on Tuesday, breaking below critical support levels after a gap lower from Friday’s close. The market’s inability to hold key technical levels highlights a bearish momentum shift, while forecasts for milder weather and a unique futures trading perspective among professionals further dampen near-term sentiment. Futures have breached two pivotal 50% support levels at $3.850 and $4.043, positioning the market for further declines. A potential test of the January 3 low at $3.330 looms as the next downside target. A recovery above $3.850 would signal the first signs of strength, with a move through $4.053 reinforcing a bullish shift. … For more info go to https://tinyurl.com/mtfspevs

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.