Natural Gas News – January 17, 2025

Natural Gas News – January 17, 2025

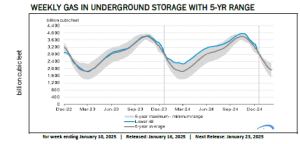

EIA Natural Gas Storage Draw Of -258 Bcf Exceeds Estimates

On January 16, 2025, EIA released its Weekly Natural Gas Storage Report. The report indicated that working gas in storage declined by -258 Bcf from the previous week, compared to analyst consensus of -255 Bcf. In the previous week, working gas in storage decreased by -40 Bcf. At current levels, stocks are 111 Bcf less than last year and 77 Bcf above the five-year average for this time of the year. Natural gas prices moved away from session highs as traders reacted to the report. The report indicated that cold weather boosted demand, and natural gas storage draw has mostly met analyst estimates. As natural gas prices rallied in recent trading sessions, some traders bet on a larger inventory draw, so they may have been disappointed by the EIA data.… https://tinyurl.com/neympdum

Nat-Gas Prices Rally on Frigid US Temps

February Nymex natural gas (NGG25) on Thursday closed up by +0.175 (+4.29%). Feb nat-gas prices Thursday settled sharply higher and are modestly below Monday’s 1-year nearest-futures high. The outlook for colder US weather that will boost heating demand for nat-gas is pushing prices higher. Forecaster Maxar Technologies said Thursday that weather models shifted colder for the northern and western part of the US for Jan 21-25, with near-record low temperatures for the eastern half of the US. Nat-gas prices also found support Thursday on a large draw in weekly supplies after the EIA reported that nat gas inventories for the week ended January 10 fell -258 bcf.… For more info go to https://tinyurl.com/2rxnd5jp

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.